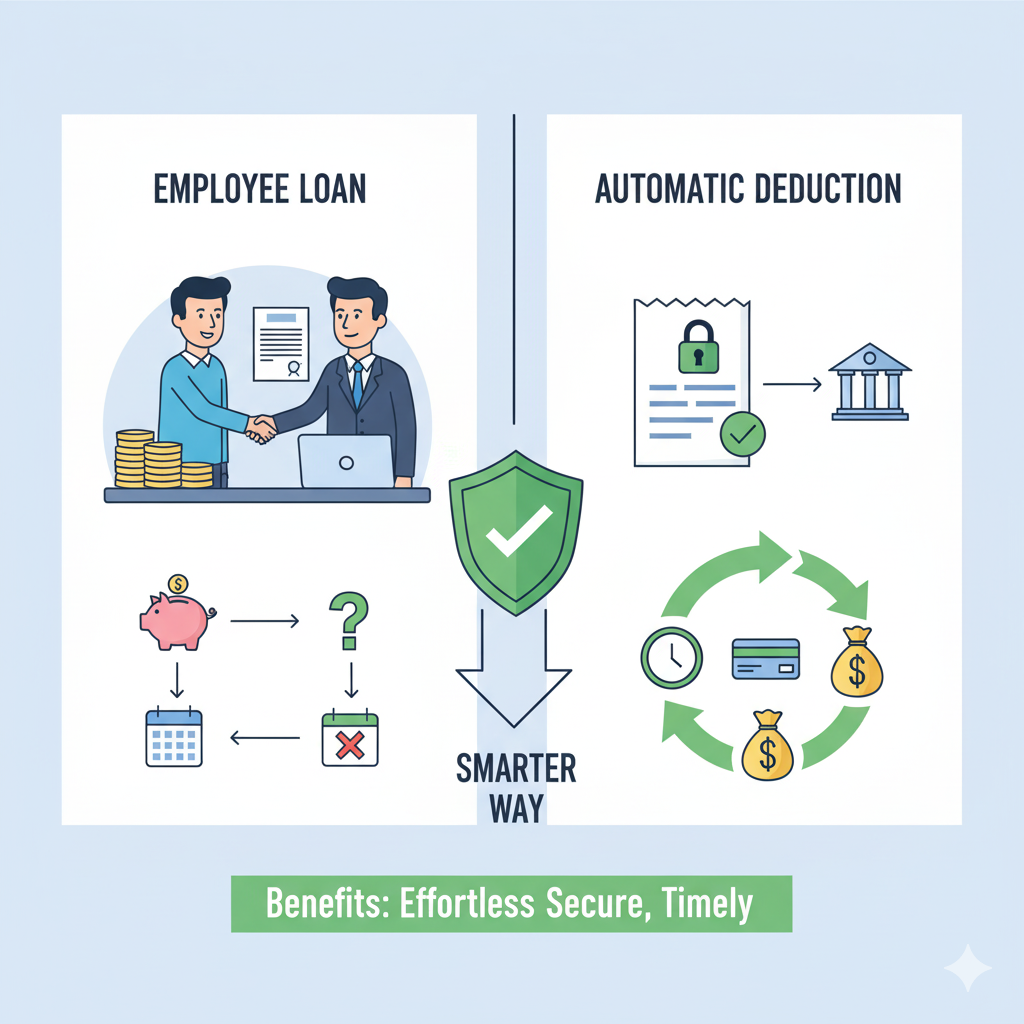

Managing employee loans can be challenging—especially when repayments are handled manually. Mistakes in deduction amounts, delays in updates, and lack of transparency can create unnecessary stress for HR, finance teams, and employees alike.

That’s where automatic payroll deductions come in. By automating the process of deducting loan repayments directly from employee salaries, businesses can ensure accuracy, save time, and improve financial management.

In this article, we’ll explore how automatic payroll deductions work, their benefits, and how to implement them effectively in your organization.

What Are Automatic Payroll Deductions?

Automatic payroll deductions are system-generated loan repayments automatically subtracted from an employee’s salary during each payroll cycle.

These deductions can cover:

- Employee loans or salary advances

- Company-provided benefits (like insurance or equipment purchase plans)

- Retirement contributions or savings programs

Once set up, the system automatically deducts the correct amount every pay period until the loan is fully repaid—eliminating manual input and reducing the risk of errors.

Why Automate Employee Loan Deductions?

Automation brings both efficiency and accuracy to your payroll process. Here’s why it’s the smarter choice:

a. Improved Accuracy

Manual deductions are prone to human error. Automating ensures consistent, precise calculations based on the loan balance and repayment schedule.

b. Time Savings

Automation significantly reduces the administrative burden on HR and payroll teams, allowing them to focus on more strategic tasks.

c. Compliance and Transparency

With clear deduction records and audit trails, you maintain compliance with labor laws and provide employees full visibility into their repayments.

d. Better Employee Trust

When loan deductions are timely and error-free, employees gain confidence that their financial matters are handled fairly and professionally.

e. Easy Integration with Payroll Systems

Modern payroll software integrates seamlessly with HR and finance systems, allowing real-time tracking of loan balances and repayment progress.

How Automatic Payroll Deductions Work

The automation process is simple yet powerful:

- Loan Setup: HR inputs loan details—total amount, interest rate (if any), repayment terms, and start date—into the payroll system.

- System Configuration: The software calculates the deduction per pay period based on the repayment schedule.

- Automatic Deduction: Each payroll run automatically subtracts the correct amount from the employee’s salary.

- Tracking and Reporting: Both the HR department and employees can track deductions and outstanding balances through dashboards or payslips.

How to Implement Automatic Payroll Deductions

If your organization is new to automation, follow these steps to ensure a smooth setup:

Step 1: Choose a Reliable Payroll System

Select a payroll software that supports automated deductions, integrates with HR and accounting platforms, and provides reporting tools.

Step 2: Establish Clear Policies

Define company policies for employee loans, repayment schedules, and deduction limits. Ensure transparency and compliance with labor laws.

Step 3: Train HR and Finance Teams

Provide proper training on using the system to input, monitor, and adjust deductions when needed.

Step 4: Communicate with Employees

Inform employees about how the deductions work, repayment terms, and where they can view their loan balance.

Step 5: Monitor and Audit Regularly

Regular audits help ensure deductions remain accurate and systems function as intended.

Benefits of Automating Loan Deductions

| Benefit | Description |

| Accuracy | Reduces human error in payroll processing |

| Efficiency | Saves HR time and administrative costs |

| Compliance | Maintains proper documentation and legal adherence |

| Transparency | Provides clear visibility for employees |

| Scalability | Easily handles multiple employees and loan types |

Best Practices for Payroll Automation

- Keep Employee Data Up to Date: Ensure any changes in employment status or salary reflect in the payroll system.

- Use Cloud-Based Solutions: Enables accessibility, security, and easy updates.

- Integrate with Accounting Systems: Streamlines financial reporting and reconciliation.

- Perform Regular Backups: Protect data integrity and prevent loss in case of system issues.

Conclusion

Automatic payroll deductions aren’t just a convenience—they’re a strategic tool for smarter, more efficient business operations.

By implementing automated employee loan deductions, companies can reduce errors, improve compliance, and foster a culture of transparency and trust.

If your organization still relies on manual processes, now is the time to embrace payroll automation and make employee loan management effortless.