If you’ve ever checked your payslip or payroll records in the Philippines, you might have noticed a line labeled “Taxable (S-7.4 Prev. Employer).” Many employees get confused about what it means, why it appears, and how it affects their take-home pay.

This guide breaks down Taxable (S-7.4 Prev. Employer) in simple terms, explaining its purpose in BIR reporting, payroll compliance, and employee taxation.

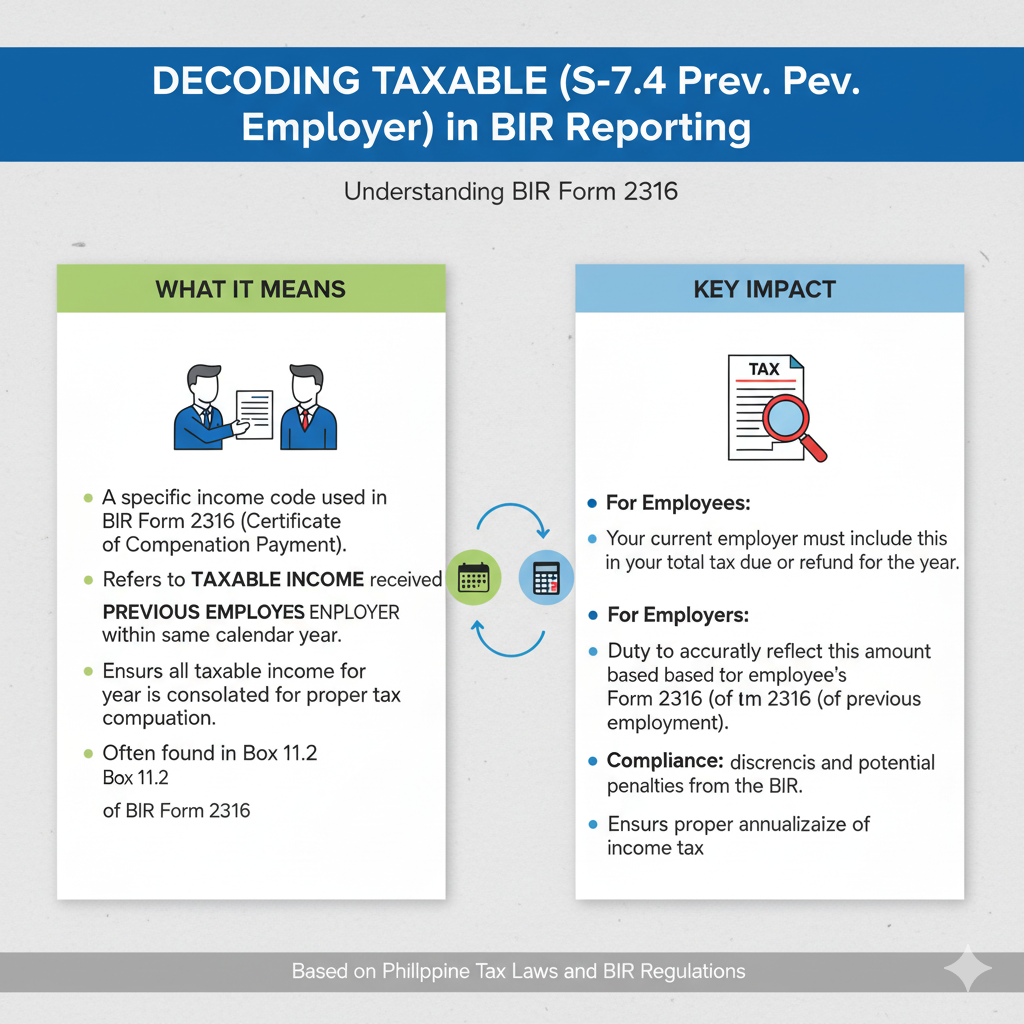

What Does “Taxable (S-7.4 Prev. Employer)” Mean?

In Philippine payroll systems, Taxable (S-7.4 Prev. Employer) refers to taxable income from a previous employer within the same calendar year.

When an employee transfers jobs during the year, the new employer must include taxable income earned from the previous employer to correctly compute annual taxes.

📌 In short: It ensures your total income (from both your old and new employer) is included for proper withholding tax calculation under BIR rules.

Why Does It Appear in Payslips?

The line Taxable (S-7.4 Prev. Employer) appears because:

- You worked for another company in the same year.

- Your new employer asked for your BIR Form 2316 from your previous employer.

- Payroll systems record this taxable amount separately to reflect cumulative income reporting.

This avoids underpayment or overpayment of taxes at the end of the year.

How It Affects Employees

- Accurate Tax Withholding – Ensures the new employer deducts the correct amount of tax.

- Prevents Double Taxation – BIR recognizes that you already paid taxes with your old employer.

- Visible on Payslip – Provides transparency by showing taxable income carried over.

- Annualization of Tax – During year-end payroll, your new employer recalculates tax based on total annual income (old + new job).

How It Affects Employers

- Payroll Compliance – Employers must consolidate income from previous jobs to avoid errors.

- Accurate BIR Reporting – Reported in BIR Form 2316 to reflect the employee’s full taxable income for the year.

- Avoids Penalties – Incorrect reporting may result in discrepancies or penalties during audits.

Example Scenario

Ana worked at Company A from January to June, earning ₱300,000. She then moved to Company B from July to December, earning ₱400,000.

- Company B must include ₱300,000 (Taxable S-7.4 Prev. Employer) in her payroll records.

- Her total taxable income for 2025 becomes ₱700,000.

- Taxes are computed based on the combined income, not just the salary from Company B.

Key BIR Reporting Forms Involved

- BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld): Must reflect both previous and current employer income.

- Alphalist of Employees: Employers submit this with accurate taxable amounts.

- Annualization of Tax: Done by the current employer to ensure correct withholding.

Best Practices for Employees

- Always request BIR Form 2316 from your previous employer.

- Submit it immediately to your new HR/payroll department.

- Check your payslip — confirm that Taxable (S-7.4 Prev. Employer) appears if you switched jobs mid-year.

- Review your annual tax summary to ensure proper withholding.

Best Practices for Employers

- Require BIR Form 2316 from new hires who changed jobs mid-year.

- Encode the taxable amount under Taxable (S-7.4 Prev. Employer) in payroll.

- Verify cumulative taxes to avoid under/over withholding.

- Stay updated with BIR tax circulars on reporting rules.

Conclusion

The entry “Taxable (S-7.4 Prev. Employer)” is simply a way for payroll systems in the Philippines to record taxable income from an employee’s previous employer. It ensures compliance with BIR reporting, accurate withholding tax calculations, and transparent payroll records.

By understanding this payroll code, both employees and employers can avoid tax issues and ensure proper reporting at year-end.