For VAT-registered businesses in the Philippines, BIR compliance goes beyond filing monthly and quarterly returns. One critical requirement is the submission of Relief Sales, which are part of the Summary List of Sales (SLS) under the BIR’s RELIEF (Reconciliation of Listings for Enforcement) System.

Unfortunately, many taxpayers make errors when filing Relief Sales, leading to penalties, rejected submissions, or unnecessary audits. In this guide, we’ll explain what Relief Sales are, the most common mistakes in filing, and how to avoid them to stay compliant.

What Are Relief Sales?

Relief Sales refer to the list of all sales transactions made by a VAT-registered taxpayer within a specific reporting period. These are reported through the BIR RELIEF System for cross-checking against buyer’s purchases.

Why Relief Sales matter:

- Ensures accuracy of Output VAT reporting.

- Helps the BIR cross-match your declared sales with your customers’ purchases.

- Avoids penalties for underreporting or misreporting.

Who Is Required to File Relief Sales?

- VAT-registered businesses engaged in sales subject to VAT.

- Taxpayers required to file the Summary List of Sales (SLS) quarterly.

- Businesses transacting with VAT-registered customers.

👉 Non-VAT registered businesses are generally not required to submit Relief Sales.

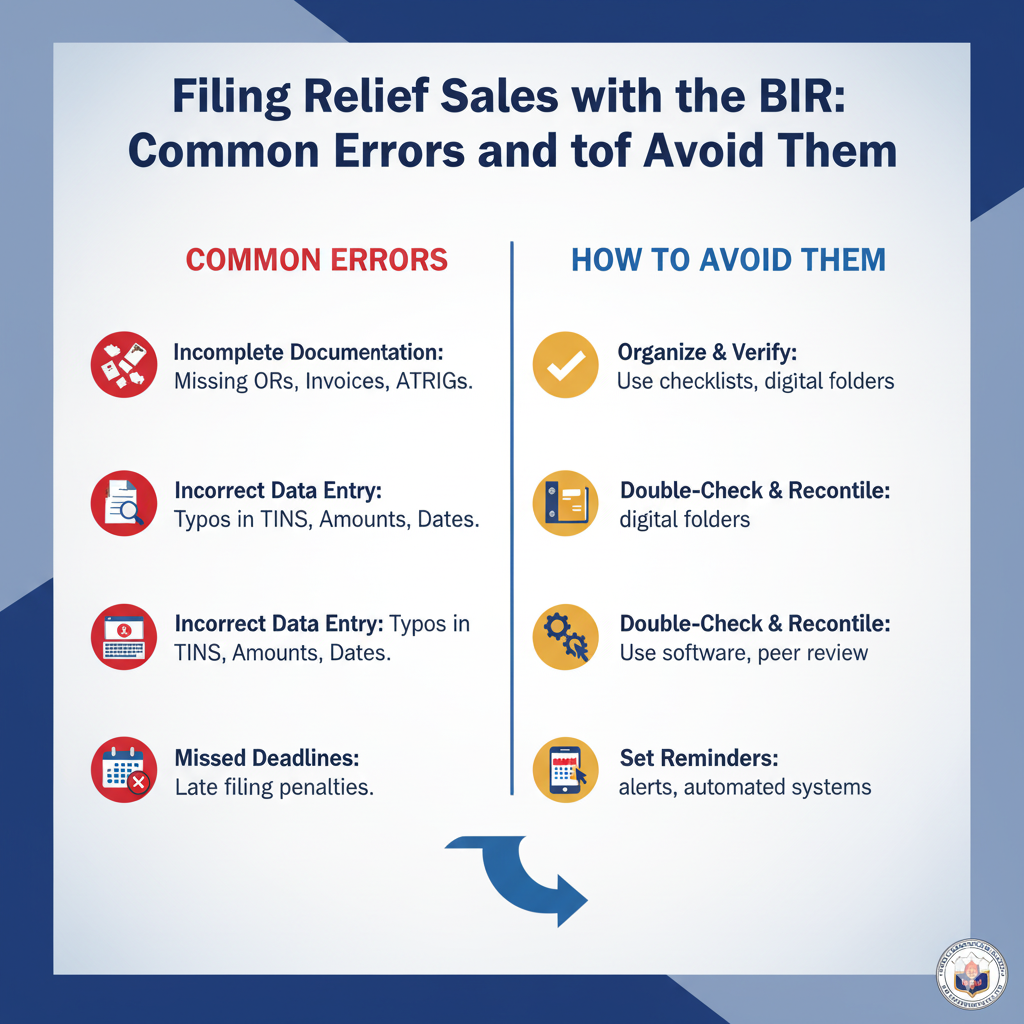

Common Errors When Filing Relief Sales

Error 1: Incorrect or Missing TINs of Customers

One of the most frequent causes of rejected Relief Sales is entering an incorrect or missing Taxpayer Identification Number (TIN) for your buyers.

How to avoid it:

- Always validate customer TINs.

- Keep a database of your frequent buyers’ correct TINs.

- Double-check TIN format before encoding.

Error 2: Wrong or Incomplete Invoice Numbers

Relief Sales reports require valid Invoice or OR Numbers. Mistakes like duplicates, missing numbers, or incomplete details can cause discrepancies.

How to avoid it:

- Use a standardized invoice numbering system.

- Make sure every sales transaction has a valid supporting document.

Error 3: Incorrect VAT Computations

If your reported sales don’t align with declared Output VAT in your VAT returns, the BIR may flag it.

How to avoid it:

- Ensure sales values and VAT in your Relief Sales match your VAT return (Form 2550M/2550Q).

- Use accounting software for accurate VAT tracking.

Error 4: Late Submission of Relief Sales

The deadline for Relief Sales is 30 days after the close of each quarter. Many businesses overlook this and incur penalties.

How to avoid it:

- Mark BIR deadlines on your business calendar.

- Assign a staff or accountant specifically for compliance reminders.

Error 5: Submitting in the Wrong File Format

The BIR Relief System requires a .DAT file generated by the RELIEF software. Submitting in Excel, PDF, or Word formats will not be accepted.

How to avoid it:

- Always use the official BIR RELIEF System.

- Test your file before submission to ensure it is valid.

Penalties for Errors in Relief Sales

Non-compliance with Relief Sales reporting can lead to:

- ₱1,000 fine per failure (up to ₱25,000 annually).

- Possible audit investigation by the BIR.

- Delays in tax clearance or business permit renewals.

Best Practices for Accurate Relief Sales Filing

✅ Maintain a well-organized accounting system.

✅ Regularly reconcile sales with VAT returns.

✅ Validate TINs and invoices before encoding.

✅ File early to avoid last-minute errors and penalties.

✅ Keep both digital and physical copies of your submissions.

Conclusion

Filing Relief Sales with the BIR is a vital part of VAT compliance for businesses in the Philippines. While the process may seem routine, common errors like wrong TINs, incorrect invoices, and late submissions can lead to penalties and audits.

By understanding these pitfalls and adopting best practices, your business can file Relief Sales accurately, stay compliant, and avoid unnecessary trouble with the BIR.