In the Philippines, every employer is required to remit Home Development Mutual Fund (HDMF) contributions, more commonly known as Pag-IBIG contributions, for their employees. Alongside payment, employers must also file the HDMF Contribution Monthly Report to ensure that contributions are properly credited.

This report is vital in securing employees’ access to Pag-IBIG benefits, such as housing loans, savings programs, and calamity assistance. For employers, proper and timely filing of this monthly report ensures compliance with government regulations and avoids penalties.

This article will guide you through everything you need to know about the HDMF Contribution Monthly Report — its purpose, filing deadlines, step-by-step process, and common errors to avoid.

What Is the HDMF Contribution Monthly Report?

The HDMF Contribution Monthly Report, also known as MCRF (Monthly Contribution Remittance Form), is a document employers submit to the Pag-IBIG Fund along with their monthly payments.

It contains:

- Employer details

- List of employees with their respective Pag-IBIG numbers

- Employer and employee contribution amounts

- Total monthly contributions remitted

This ensures that both employer and employee contributions are properly posted to individual Pag-IBIG accounts.

Who Needs to File the Report?

All employers in the Philippines, including:

- Private companies (corporations, partnerships, SMEs)

- Government agencies

- Household employers (for kasambahays)

Employers with at least one employee under their payroll.

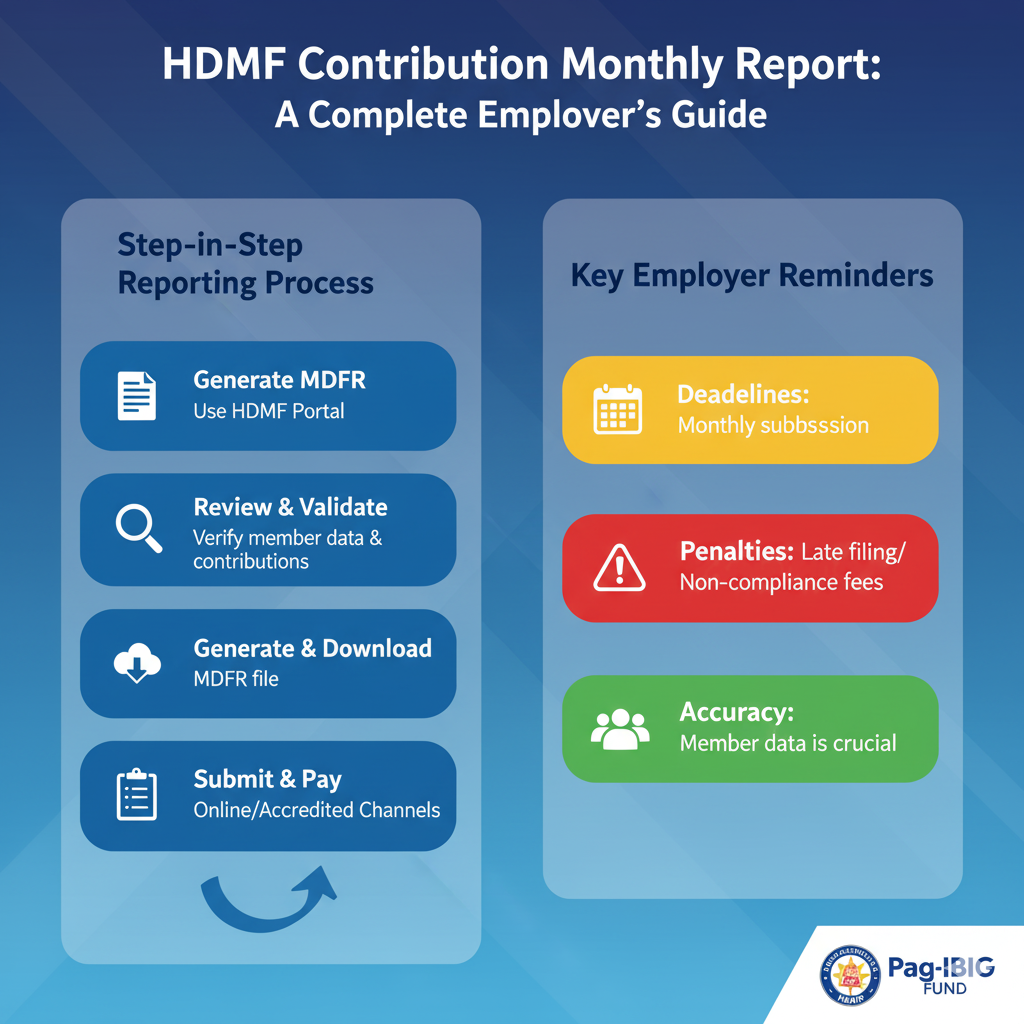

Deadlines for HDMF Contribution Monthly Report

Employers are required to remit and report contributions on or before the 10th day of the following month.

📌 Example:

Contributions for September → Must be remitted and reported by October 10.

Failure to file on time may result in penalties and surcharges.

Step-by-Step Guide: Filing the HDMF Contribution Monthly Report

Step 1: Generate the Payment Reference Number (PRN)

- Log in to the Pag-IBIG Employer Registration System (ERMS) or go to a Pag-IBIG branch.

- Generate the Payment Reference Number (PRN) for monthly contributions.

- The PRN ensures correct posting of payments.

Step 2: Prepare the Monthly Contribution Remittance Form (MCRF)

- Download the latest MCRF template from the Pag-IBIG website.

- Encode employee details, Pag-IBIG MID numbers, and contribution amounts.

- Verify employer and employee shares are accurate (usually 2% of monthly compensation, subject to Pag-IBIG rules).

Step 3: Pay the Contributions

Employers can remit contributions through:

- Pag-IBIG branches

- Accredited banks and payment centers

- Online payment channels (GCash, PayMaya, etc.)

- The Virtual Pag-IBIG portal

Step 4: Submit the Monthly Report

- For online submission: Upload the MCRF through Virtual Pag-IBIG or employer online services.

- For manual filing: Submit the printed MCRF with proof of payment at the nearest Pag-IBIG office.

Step 5: Secure Proof of Submission

- Keep the acknowledgment receipt or transaction confirmation from Pag-IBIG.

- Maintain both hard and digital copies of reports for at least 10 years for audit purposes.

Common Errors in Filing HDMF Contribution Monthly Reports

❌ Error 1: Incorrect Pag-IBIG MID Numbers

Reports may be rejected if employee Pag-IBIG numbers are missing or incorrect.

✅ Solution: Ask employees to update and confirm their Pag-IBIG numbers.

❌ Error 2: Wrong Contribution Amounts

Using outdated contribution rates leads to discrepancies.

✅ Solution: Always refer to the latest Pag-IBIG contribution schedule.

❌ Error 3: Missing Employees in the Report

Failing to add new hires or removing resigned staff can cause compliance issues.

✅ Solution: Update employee records before generating reports.

❌ Error 4: Late Submission

Not filing before the 10th of the month leads to penalties.

✅ Solution: File contributions at least 2–3 days before the deadline.

Penalties for Non-Compliance

Employers who fail to remit and report Pag-IBIG contributions may face:

- 2% monthly penalty on late remittances

- Legal action for non-remittance of employee contributions

- Difficulty in securing government clearances or accreditations

Best Practices for Employers

✅ Register all employees with Pag-IBIG upon hiring.

✅ Use the PRN to ensure accurate posting of contributions.

✅ Regularly reconcile contributions with employee payslips.

✅ File contributions early to avoid system downtime or long lines.

✅ Train payroll staff on Pag-IBIG compliance.

Conclusion

The HDMF Contribution Monthly Report is an essential compliance requirement for employers in the Philippines. By filing accurately and on time, employers not only avoid penalties but also ensure that their employees continue to enjoy the full benefits of the Pag-IBIG Fund.

Following the step-by-step process outlined above — from generating a PRN to filing the MCRF — will make reporting seamless and stress-free. Remember, compliance with Pag-IBIG obligations reflects your commitment to your employees’ welfare and financial security.