When looking at your payslip in the Philippines, you might notice a section labeled “Other Allowance.” Many employees are unsure what it covers, how it differs from basic pay or benefits, and whether it’s taxable.

This guide explains what other allowance means in payroll, examples in Philippine companies, and the taxation rules under BIR (Bureau of Internal Revenue).

What Is “Other Allowance” in Payroll?

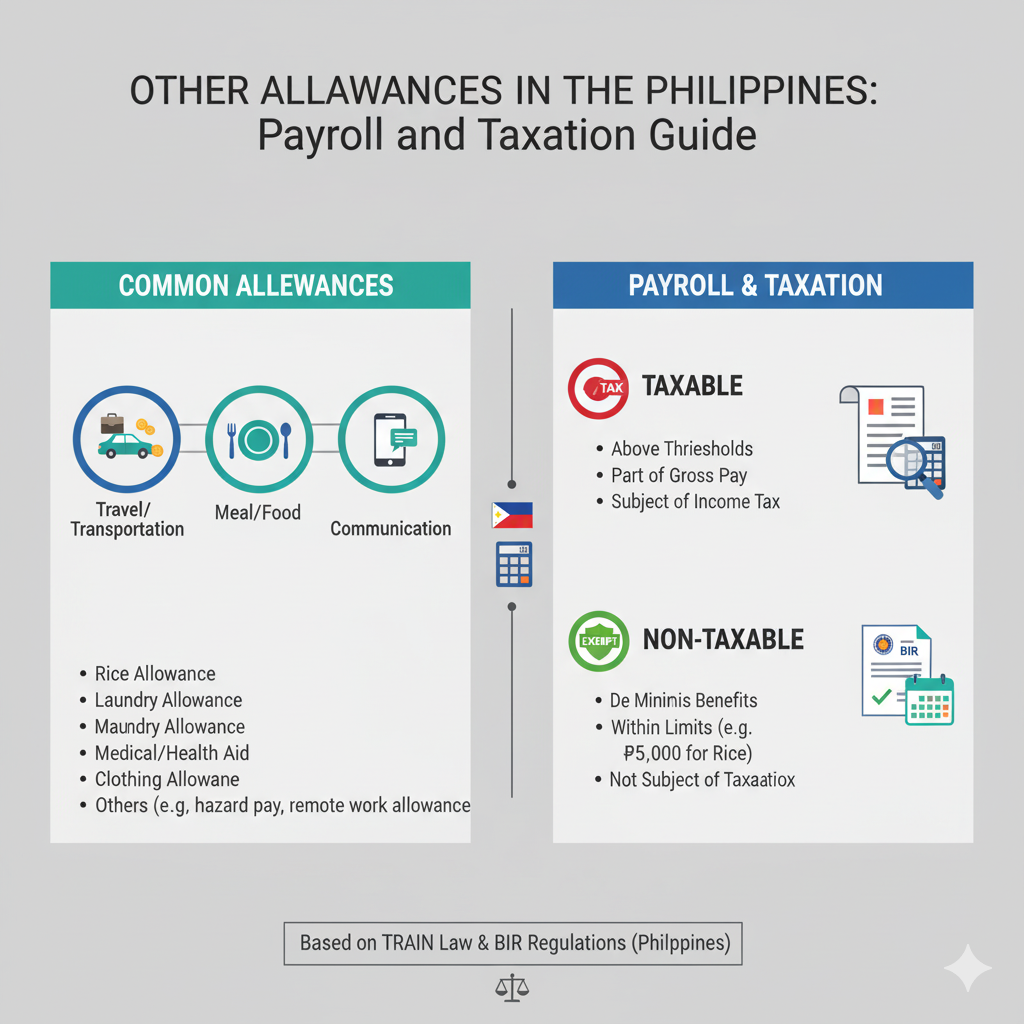

In the Philippines, other allowance refers to additional compensation or benefits that employees receive outside their basic salary. It usually falls under fringe benefits or supplementary pay, depending on its purpose.

Examples of Other Allowance:

- Transportation or travel allowance

- Communication or internet allowance

- Clothing or uniform allowance

- Meal or food subsidy

- Representation allowance (RA)

- Special project allowance

- One-time incentives not categorized as bonuses

📌 Key Point: Other allowance is meant to support employees’ work-related expenses or provide extra financial benefits.

Is Other Allowance Taxable in the Philippines?

Taxation depends on the type of allowance and whether it is considered part of compensation or a de minimis benefit.

- Tax-Free Allowances (De Minimis Benefits)

The BIR exempts certain allowances from tax if they fall under de minimis benefits and within the prescribed limits, such as:

Uniform and clothing allowance (not exceeding ₱6,000/year)

Meal allowance (not exceeding 25% of minimum wage)

Rice subsidy (up to ₱2,000/month)

Medical cash allowance (up to ₱1,500/semester for children)

- Taxable Allowances

Allowances exceeding BIR limits or considered part of additional compensation are taxable. For example:

Transportation allowance beyond the exempt ceiling

Large representation allowances

Special allowances not categorized as de minimis

📌 Tip for Employers: Always check Revenue Regulations 5-2011 and BIR updates for current exemption limits.

Payroll Compliance for Employers

Employers in the Philippines must:

- Classify Allowances Properly – Identify whether the allowance is taxable or exempt.

- Reflect on Payslips – Ensure other allowance entries are separate from basic pay.

- Deduct Withholding Tax if Needed – For taxable allowances.

- Report Correctly in BIR Forms – Include in BIR Form 2316 for employees and other annual filings.

Why Other Allowance Matters for Employees

- Financial Support – Helps cover daily expenses like transportation, meals, and communication.

- Tax Awareness – Knowing which allowances are taxable prevents surprises in your payslip.

- Fair Compensation – Transparent allowance breakdown builds trust between employer and employee.

Best Practices for Managing Other Allowance

- Employers: Use payroll software to automate classification and avoid tax errors.

- Employees: Review payslips monthly to check if allowances are correctly labeled.

- Both: Stay updated with BIR rulings and labor laws to remain compliant.

Conclusion

In the Philippines, other allowance is an important part of payroll that goes beyond basic salary. While some allowances are tax-free as de minimis benefits, others are taxable depending on BIR regulations.

For both employees and employers, understanding how allowances are classified ensures financial clarity, proper tax compliance, and smoother payroll management.