Employers in the Philippines are legally required to remit and report their employees’ PhilHealth contributions each month. This is done through the PhilHealth Contribution Monthly Report, which ensures that employee contributions are correctly recorded and credited to their accounts.

Timely filing of this report is crucial — not only for compliance but also for ensuring that employees can access PhilHealth benefits such as medical coverage, hospitalization, and financial assistance. This complete guide will walk employers through the filing process, deadlines, common errors, and best practices for hassle-free PhilHealth compliance.

What Is the PhilHealth Contribution Monthly Report?

The PhilHealth Contribution Monthly Report is a document (Form RF-1) submitted by employers that details:

- Employee information (name and PhilHealth Identification Number or PIN)

- Employer and employee share of contributions

- Total remittance for the month

This report serves as official proof of remittance and helps PhilHealth maintain accurate employee contribution records.

Who Needs to File the Report?

All employers in the Philippines, including:

- Private corporations, partnerships, and SMEs

- Government agencies

- Household employers (kasambahays)

Employers with one or more employees under their payroll.

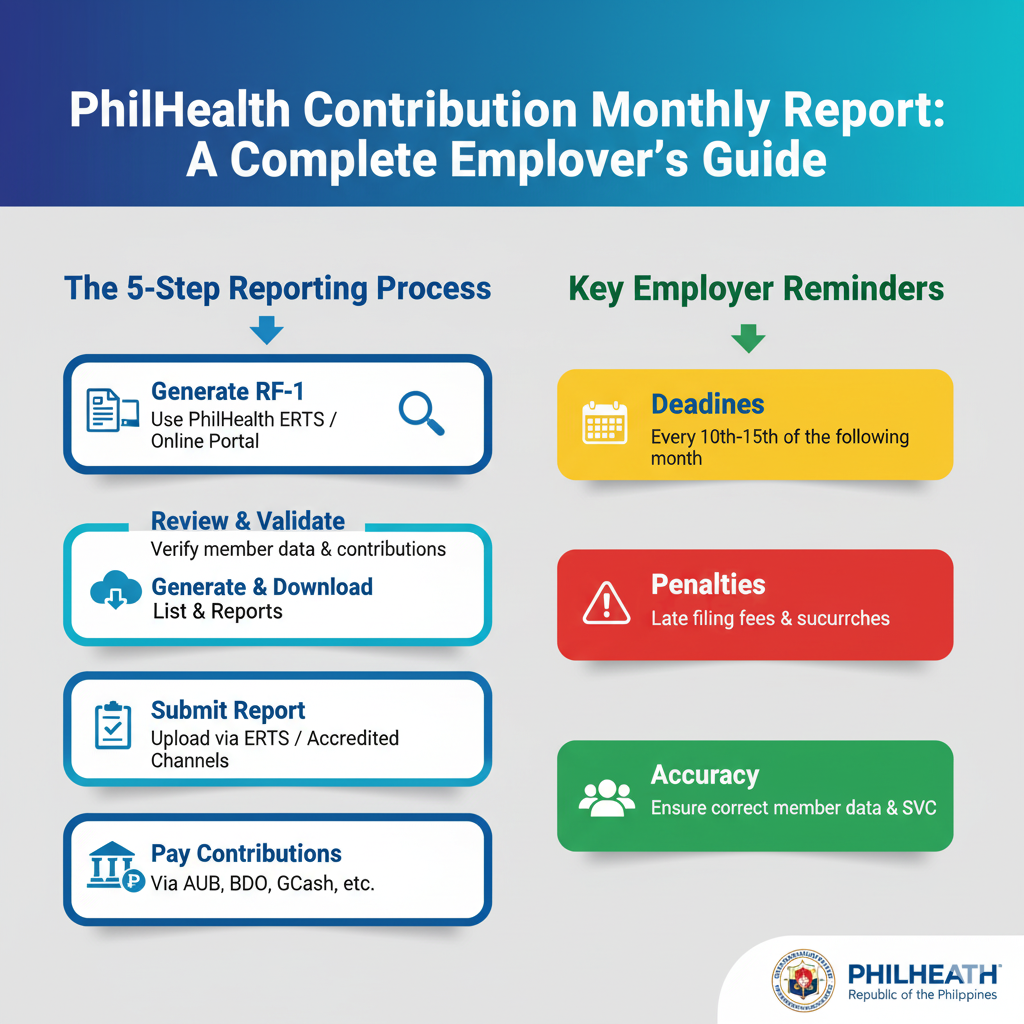

Deadlines for PhilHealth Contribution Monthly Report

Employers must remit contributions and file their reports on or before the 11th–15th day of the month following the applicable month (depending on the last digit of the employer’s PhilHealth number).

📌 Example:

Contributions for August → Due by September 11–15 (based on employer’s last digit schedule).

Late filing results in surcharges and may affect employees’ access to benefits.

Step-by-Step Guide: Filing the PhilHealth Contribution Monthly Report

Step 1: Prepare Employer and Employee Details

- Gather employee PhilHealth Identification Numbers (PINs).

- Update records for new hires or resigned employees.

Step 2: Compute Contributions

- Use the latest PhilHealth Contribution Table as basis.

- Contribution is usually shared equally by the employer and employee (unless otherwise provided).

Step 3: Fill Out the RF-1 Form

Download the PhilHealth RF-1 Form from the PhilHealth website or secure a copy at the nearest branch.

Encode:

- Employer PhilHealth Number and details

- Employee list with corresponding contributions

- Total employer + employee share

Step 4: Remit Contributions

Payments can be made via:

- Accredited banks

- PhilHealth counters and branch offices

- Online payment facilities (through PhilHealth-accredited partners)

Step 5: Submit the Monthly Report

- For manual filing: Submit the accomplished RF-1 Form and proof of payment to the nearest PhilHealth office.

- For online submission: Use the PhilHealth Employer Engagement Representatives (PEER) portal or the Electronic Premium Remittance System (EPRS) to upload contribution reports.

Step 6: Secure Proof of Submission

- Online → Download the electronic acknowledgment receipt.

- Manual → Secure the stamped receiving copy from PhilHealth.

- Keep records for at least 10 years for audit and compliance purposes.

Common Errors in Filing PhilHealth Contribution Reports

❌ Error 1: Incorrect or Missing PhilHealth Identification Numbers

Invalid PINs may cause employee contributions to be unposted.

✅ Solution: Always verify employee PINs before filing.

❌ Error 2: Using Outdated Contribution Tables

Using wrong contribution rates leads to underpayment or overpayment.

✅ Solution: Refer only to the latest PhilHealth circulars.

❌ Error 3: Late Filing or Non-Submission

Late or missed submissions affect employee benefits.

✅ Solution: Set internal payroll deadlines ahead of PhilHealth due dates.

❌ Error 4: Not Updating Employee Records

Failing to add new employees or exclude resigned ones results in errors.

✅ Solution: Regularly update payroll and HR records.

Penalties for Non-Compliance

Employers who fail to remit and report contributions may face:

- 3% per month penalty on late payments

- Legal liabilities for non-remittance of employee deductions

- Difficulty securing clearances from PhilHealth and other government agencies

Best Practices for Employers

✅ Always use the Electronic Premium Remittance System (EPRS) for faster and accurate filing.

✅ Reconcile payroll and contribution reports monthly.

✅ Train HR/payroll staff in government compliance.

✅ File contributions ahead of the deadline to avoid last-minute issues.

✅ Maintain both hard and soft copies of all reports.

Conclusion

The PhilHealth Contribution Monthly Report is a vital part of employer compliance in the Philippines. By filing accurately and on time, employers not only meet legal requirements but also protect their employees’ rights to healthcare benefits.

Following this guide — from preparing employee data to submitting the RF-1 form — will ensure smooth and penalty-free compliance. Ultimately, timely PhilHealth reporting shows a company’s commitment to its employees’ well-being and social protection.