In the Philippines, employers have the legal obligation to remit their employees’ Social Security System (SSS) contributions every month. One of the key requirements is the SSS Contribution Remittance Report, also known as the R3 report. This document ensures that employees’ contributions are properly recorded and credited to their SSS accounts.

Failure to submit this report on time can lead to penalties, surcharges, and even issues with employee benefits. This complete guide will walk you through the essentials of filing the SSS Contribution Remittance Report, step-by-step instructions, and tips to avoid compliance mistakes.

What Is the SSS Contribution Remittance Report?

The SSS Contribution Remittance Report (R3 Report) is a monthly document that employers must submit to the Social Security System. It contains:

- The list of employees covered

- Their respective SSS contributions (both employer and employee share)

- The total amount remitted for the reporting period

This report serves as proof that employers are fulfilling their responsibility to remit SSS contributions.

Who Needs to File the Report?

- Private sector employers with regular, part-time, or contractual employees.

- Household employers who hire kasambahays (house helpers).

- Corporate and small business owners employing at least one person.

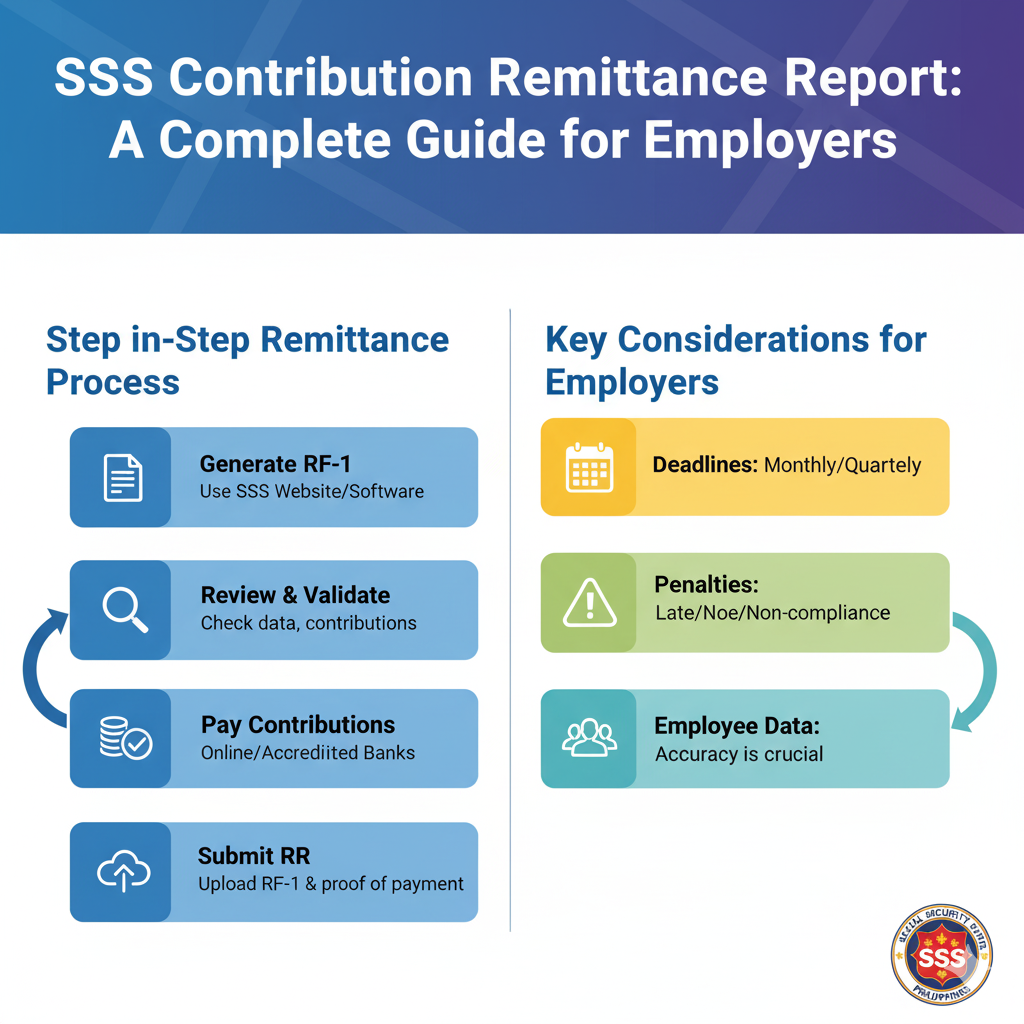

Deadlines for SSS Contribution Remittance Report

Employers must submit the SSS Contribution Remittance Report on or before the 10th day of the following month after payment.

📌 Example:

Contributions for August → Report deadline is September 10.

Late submission may result in penalties or surcharges.

Step-by-Step Guide: Filing the SSS Contribution Remittance Report

Step 1: Pay the Contributions

Compute the employer and employee contributions based on the latest SSS Contribution Schedule.

Pay via:

- SSS-accredited banks

- My.SSS online portal with payment reference number (PRN)

- Payment centers and partner apps

Step 2: Prepare the R3 File

Employers have two options:

- Manual Filing → Use the R3 form provided by SSS.

- Electronic Filing → Download the R3 File Generator Program from the SSS website and input employee data.

Step 3: Submit via My.SSS or SSS Office

- For online filing: Upload the R3 file through your My.SSS employer account.

- For manual filing: Submit the printed R3 form along with proof of payment at the nearest SSS branch.

Step 4: Secure Acknowledgment

After submission:

- Online → Save the acknowledgment email or system-generated confirmation.

- Manual → Secure the stamped copy from the SSS as proof of submission.

Common Errors in Filing SSS Contribution Reports

❌ Error 1: Using Wrong Contribution Amounts

Employers sometimes use outdated contribution schedules.

✅ Solution: Always check the latest SSS contribution table.

❌ Error 2: Incorrect Employee Information

Mismatches in SSS numbers or employee names cause rejected reports.

✅ Solution: Verify employee details with their SSS records before filing.

❌ Error 3: Late Filing

Missing the deadline leads to surcharges.

✅ Solution: Mark deadlines and file at least 2–3 days before due dates.

❌ Error 4: Failure to Update Employee Status

Not removing resigned employees or adding new hires may cause discrepancies.

✅ Solution: Regularly update employee records before report generation.

Penalties for Non-Compliance

Employers who fail to remit contributions or submit reports may face:

- 3% per month penalty on late payments

- Legal consequences for failure to remit employee deductions

- Suspension of SSS transactions and clearances

Best Practices for Employers

✅ Always use the Payment Reference Number (PRN) for faster posting of contributions.

✅ Maintain an updated employee masterlist.

✅ Reconcile payments with reports monthly.

✅ Keep both digital and hard copies of reports for at least 10 years.

✅ Train payroll staff in SSS compliance.

Conclusion

The SSS Contribution Remittance Report is a vital compliance document that ensures employees receive the social security benefits they deserve. By understanding the filing process, meeting deadlines, and avoiding common mistakes, employers can stay compliant and avoid penalties.

Staying proactive with SSS reporting not only keeps your business safe from legal issues but also builds trust with your employees by safeguarding their future benefits.