If you’ve ever reviewed your payslip in the Philippines after transferring jobs within the same year, you might have noticed a line called “Non-Taxable (S-7.5 Prev. Employer).”

This payroll code can be confusing, but it plays an important role in BIR reporting, tax compliance, and salary transparency. In this guide, we’ll explain what it means, why it appears, and how it affects both employees and employers.

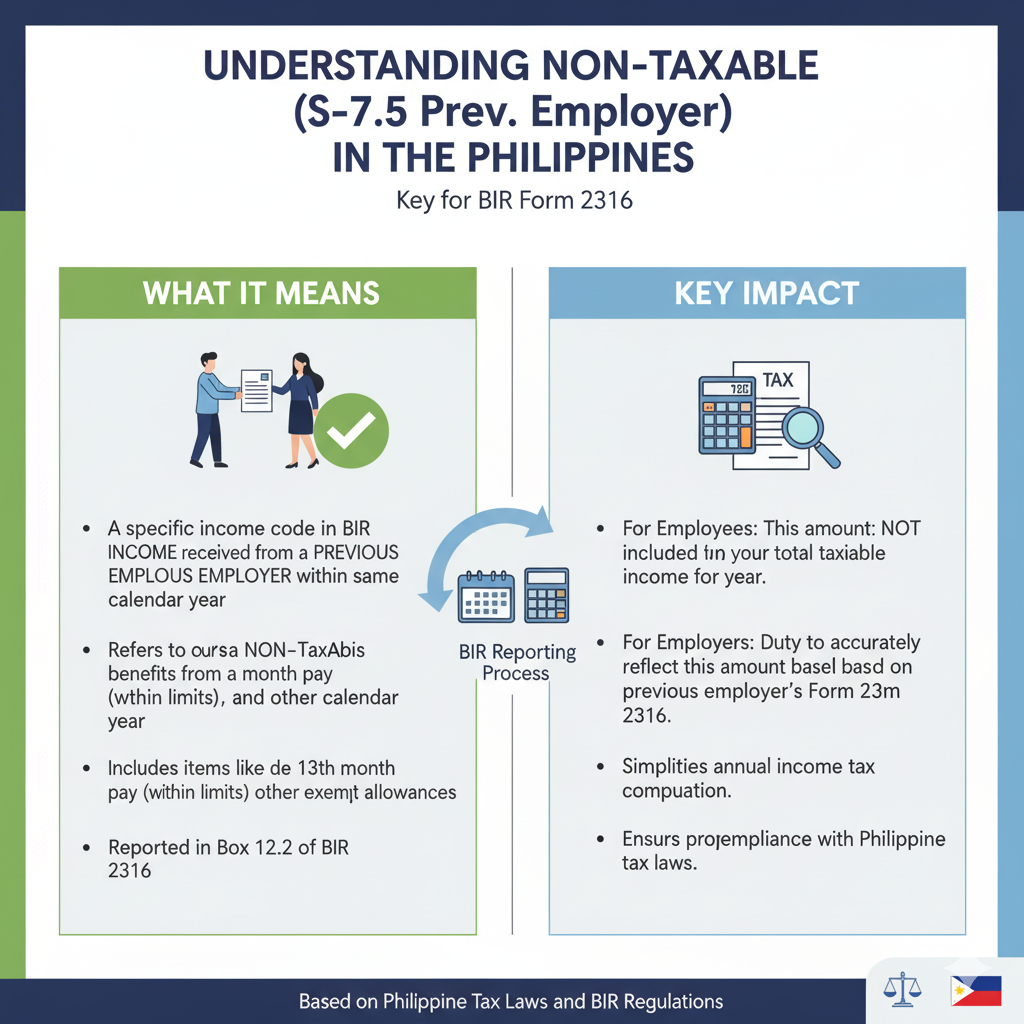

What Does “Non-Taxable (S-7.5 Prev. Employer)” Mean?

In Philippine payroll systems, Non-Taxable (S-7.5 Prev. Employer) refers to the non-taxable income or benefits earned from a previous employer within the same calendar year.

When an employee changes jobs, the new employer must record both taxable and non-taxable earnings from the old employer. This ensures accurate reporting and compliance with BIR regulations.

📌 In short: It represents non-taxable income carried over from your previous employer for consolidation in annual tax reporting.

Examples of Non-Taxable Income from a Previous Employer

- 13th Month Pay (within the ₱90,000 exemption limit)

- De Minimis Benefits (meal allowance, rice subsidy, uniform allowance, etc., within BIR limits)

- SSS, PhilHealth, and Pag-IBIG Contributions (mandatory contributions are non-taxable)

- Other Non-Taxable Allowances (if within BIR’s prescribed ceilings)

Why Does It Appear in Payslips?

The Non-Taxable (S-7.5 Prev. Employer) entry appears because:

- You submitted your BIR Form 2316 from your previous employer.

- Payroll software records non-taxable earnings separately from taxable earnings.

- It ensures full income transparency and proper classification of benefits.

This avoids misreporting and ensures that non-taxable benefits remain exempt even after a job transfer.

Impact on Employees

- Transparency – Helps employees see how their past income is classified.

- Tax Clarity – Ensures non-taxable benefits remain exempt, even after switching jobs.

- Accurate Reporting – Prevents double taxation by properly separating taxable and non-taxable income.

Impact on Employers

- Payroll Compliance – Employers must reflect both taxable and non-taxable income when annualizing tax.

- Accurate BIR Filing – Must appear in BIR Form 2316 and employee tax records.

- Employee Trust – Clear payslip entries prevent confusion and disputes.

Example Scenario

Mark worked at Company A from January to June, where he received:

₱400,000 taxable salary

₱50,000 in non-taxable de minimis benefits

When he transferred to Company B in July:

Company B recorded ₱400,000 under Taxable (S-7.4 Prev. Employer)

₱50,000 under Non-Taxable (S-7.5 Prev. Employer)

This way, Mark’s total income was reported correctly, and his ₱50,000 in non-taxable benefits stayed exempt from tax.

Best Practices

For Employees

- Always secure BIR Form 2316 from your previous employer.

- Submit it to your new HR/payroll department.

- Review payslips carefully to ensure correct classification.

For Employers

- Require new hires to submit 2316 forms immediately.

- Encode both S-7.4 (Taxable) and S-7.5 (Non-Taxable) values in payroll.

- Stay updated with BIR rulings on de minimis and 13th month exemptions.

Conclusion

The payroll entry “Non-Taxable (S-7.5 Prev. Employer)” is not something to worry about — it simply represents non-taxable benefits carried over from a previous employer in the Philippines.

It ensures that allowances, benefits, and contributions remain exempt even when you change jobs, keeping payroll and BIR reporting accurate and compliant.