Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

Have you ever received a payroll adjustment labeled “add back pay” and wondered what it means? Back pay, sometimes called salary arrears, refers to the money owed to an employee for work they have already completed but were not paid for on time.

This guide explains what add back pay is, when employees are entitled to it, and the employer’s legal duties when handling back pay.

Back pay is the difference between what an employee was paid and what they should have been paid. When it is added back into payroll, it corrects previous underpayments or missed payments.

Common reasons back pay is added include:

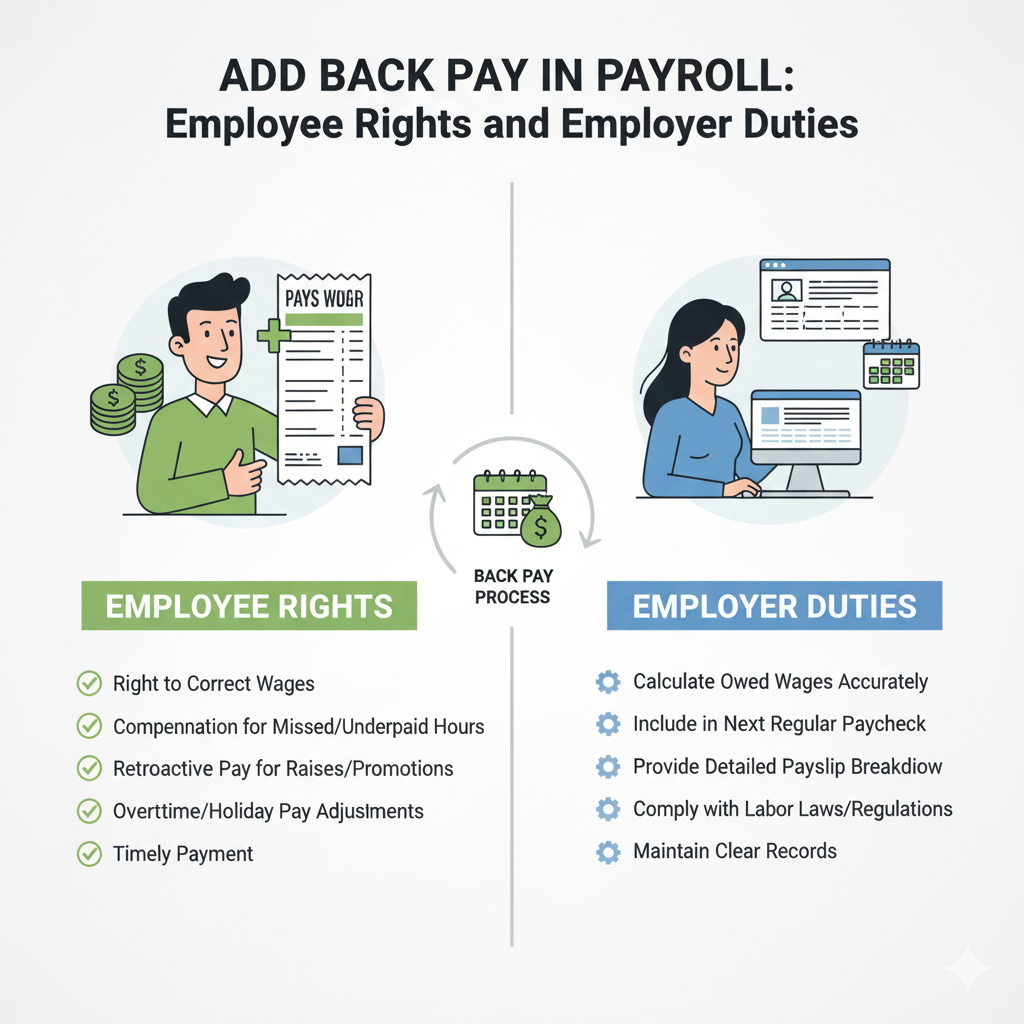

Employees have the right to receive full and timely compensation for the work they have performed. If wages are delayed, miscalculated, or withheld, the employee can demand the difference.

Key employee rights include:

In many countries, labor codes protect workers’ rights to back pay and allow them to file complaints if employers fail to comply.

Employers must handle back pay responsibly to stay compliant with labor and tax laws. Their duties include:

The calculation depends on the reason for the adjustment.

👉 Example: An employee’s salary was increased from ₱25,000 to ₱27,000 effective last month, but payroll only reflected the old salary.

Missed Salary Difference: ₱2,000

Missed Periods: 1 month

Back Pay Owed: ₱2,000 × 1 = ₱2,000

This amount is then added back in the next payroll cycle, shown as “Add Back Pay.”

Add back pay in payroll is not just a correction — it’s a matter of employee rights and employer responsibility. Employees deserve to be fully compensated for their work, while employers are legally and ethically obligated to make accurate payments.

By ensuring transparency, compliance, and timely adjustments, businesses can build trust and avoid costly disputes.