Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

Human Capital Management

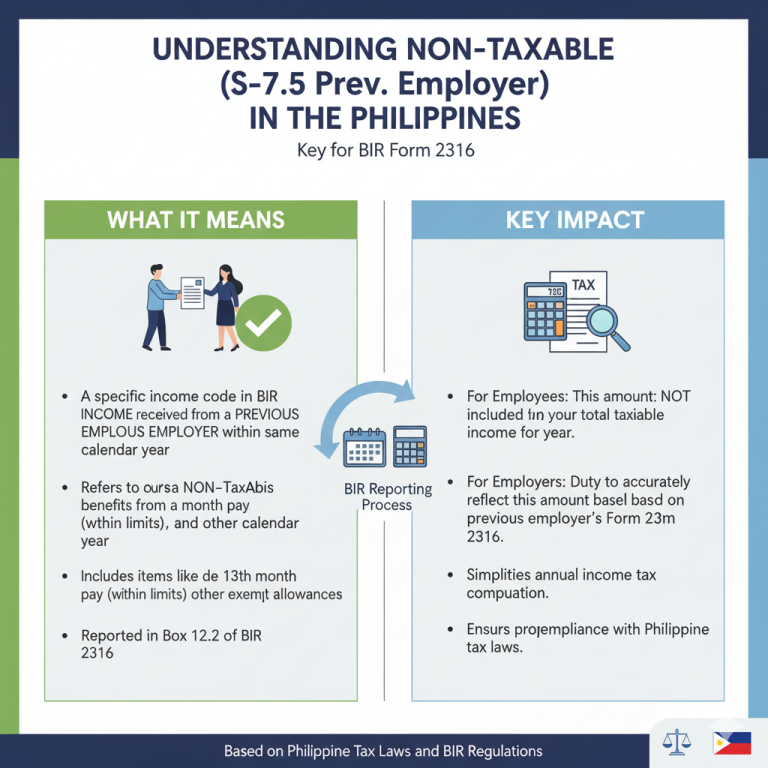

If you’ve ever reviewed your payslip in the Philippines after transferring jobs within the same year, you might have noticed a line called “Non-Taxable (S-7.5 Prev. Employer).” This payroll code can be confusing, but it plays an important role in…

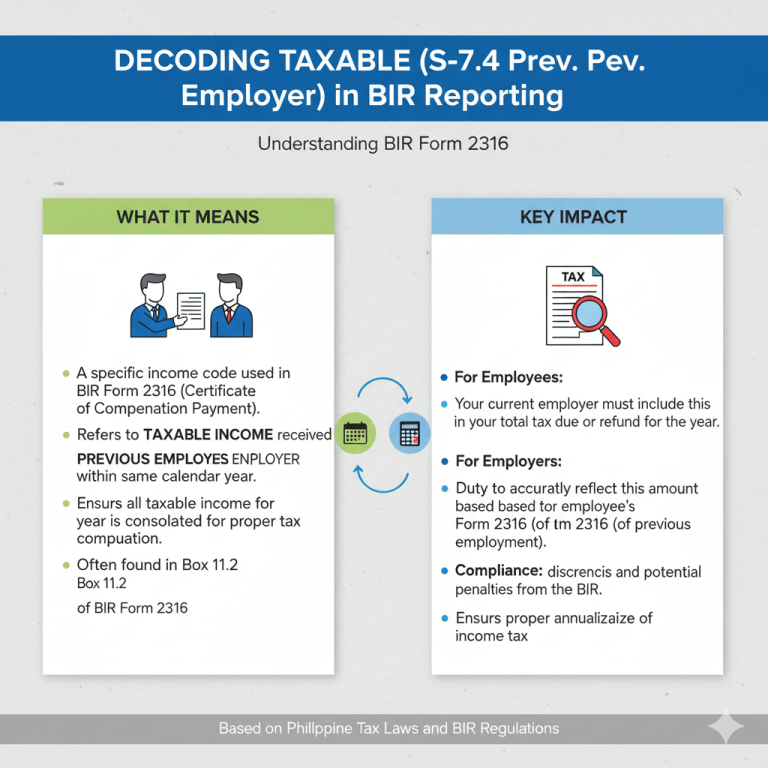

If you’ve ever checked your payslip or payroll records in the Philippines, you might have noticed a line labeled “Taxable (S-7.4 Prev. Employer).” Many employees get confused about what it means, why it appears, and how it affects their take-home…

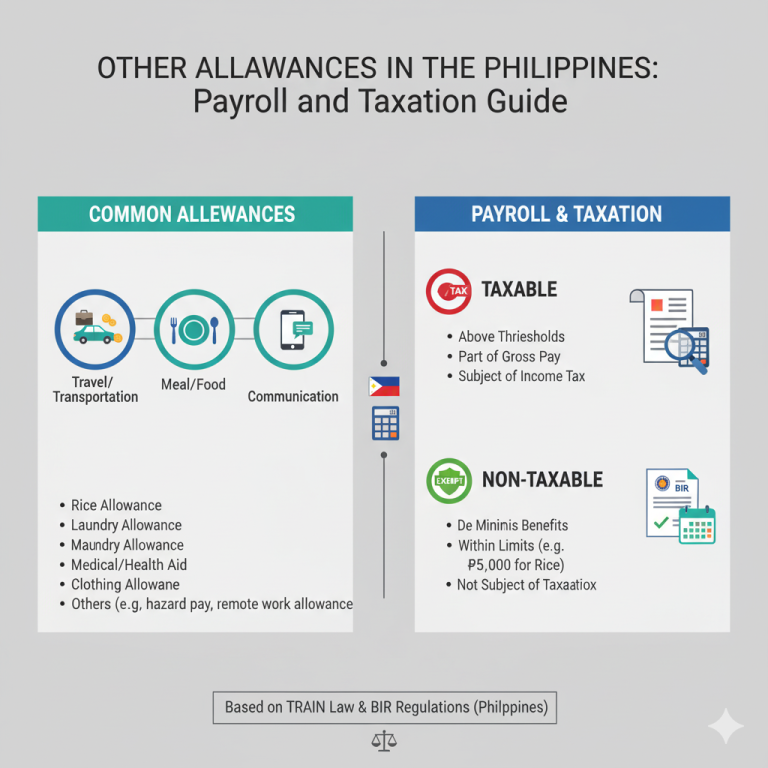

When looking at your payslip in the Philippines, you might notice a section labeled “Other Allowance.” Many employees are unsure what it covers, how it differs from basic pay or benefits, and whether it’s taxable. This guide explains what other…

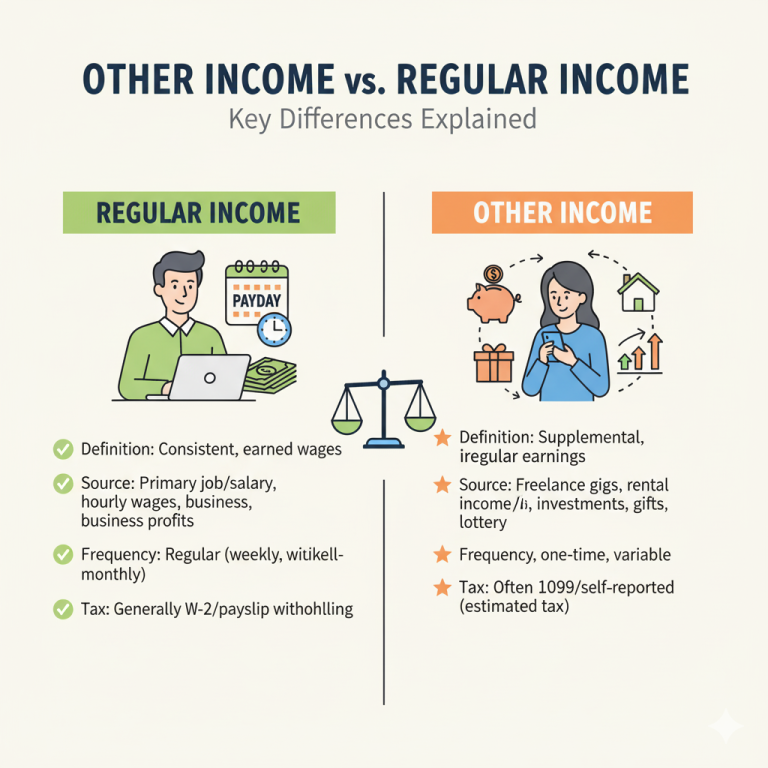

When it comes to payroll and taxes, not all income is treated the same way. You may see the terms regular income and other income on your payslip or tax return. While both contribute to your total earnings, they are…

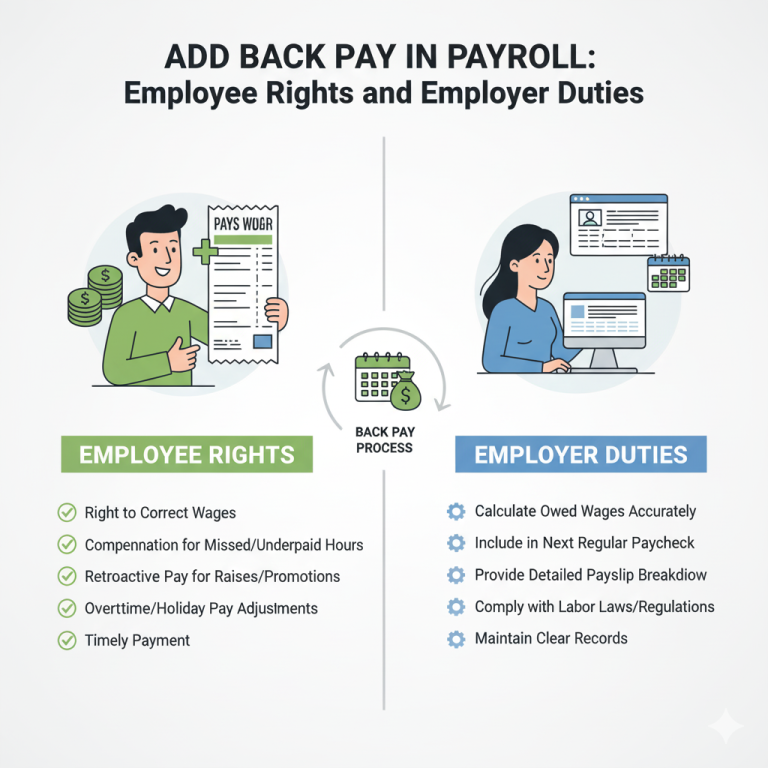

Have you ever received a payroll adjustment labeled “add back pay” and wondered what it means? Back pay, sometimes called salary arrears, refers to the money owed to an employee for work they have already completed but were not paid…

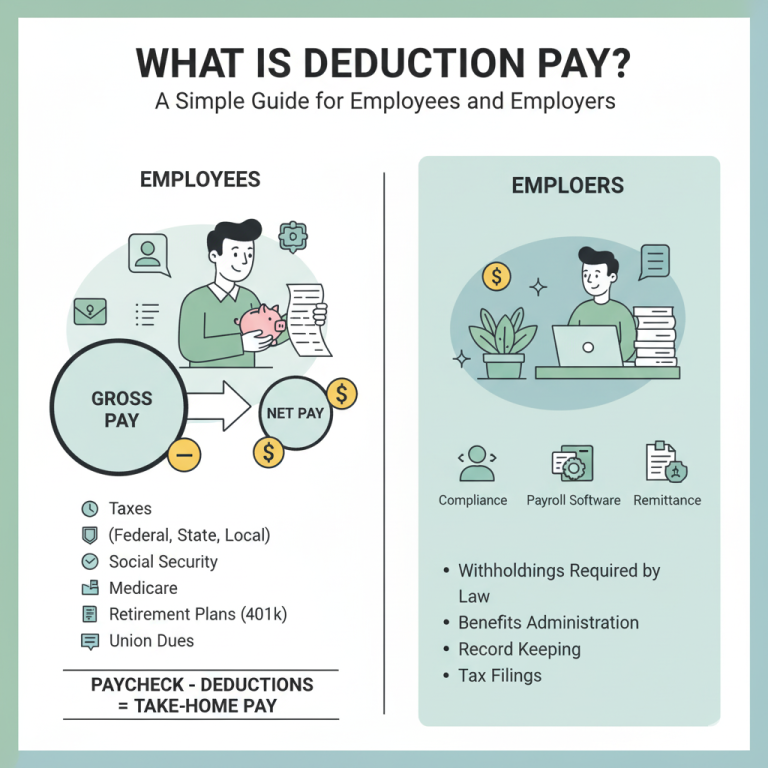

If you’ve ever received your payslip and wondered why the amount you take home is lower than your gross salary, you’re not alone. This difference is due to deduction pay. Understanding what gets deducted — and why — is essential…

When an employee resigns, retires, or is terminated, one of the most important questions they ask is: “How much is my final pay?” In the Philippines, this is commonly referred to as the Employee Final Fee or Final Pay. Understanding…

In the Philippines, the 13th month pay is one of the most anticipated benefits employees receive every year. Required by law under Presidential Decree No. 851, this extra compensation helps workers cover holiday expenses and boosts morale. But for many,…

In the Philippines, the 13th month pay is more than just an extra paycheck—it’s a legally mandated benefit that employees look forward to, especially during the holiday season. But for many, the details of how it’s calculated, whether it’s taxable,…

In any organization, people are the most valuable asset—and also one of the biggest expenses. To make informed business decisions, companies must track not just payroll costs but also the number of employees over time. This is where the Year-To-Date…