Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

Human Resources Information System

Managing employee leave requests can be a headache for HR teams and managers. Traditional methods—paper forms, emails, or spreadsheets—often result in delays, errors, and miscommunication. Employees may not know their remaining leave balances, while HR struggles with manual tracking. This…

For many organizations, managing overtime filing is one of the most challenging aspects of payroll and workforce management. Manual processes often result in errors, delayed approvals, compliance issues, and even disputes between employees and management. This is why more businesses…

Timesheet filing has always been an important part of workforce management. It helps businesses accurately record employee hours, calculate payroll, and comply with labor laws. However, manual timesheet filing—whether through paper forms or spreadsheets—often leads to errors, delays, and inefficiencies.…

For businesses in the Philippines, preparing and submitting SSS R3 files is a critical part of payroll compliance. The SSS R3 file contains detailed contribution records of employees, and errors in submission can lead to penalties, delays, or employee dissatisfaction.…

Managing employee loan deductions can be a challenging task for HR and payroll teams. Manual tracking often leads to calculation errors, compliance risks, and frustrated employees. This is where a Human Resource Information System (HRIS) integrated with a payroll system…

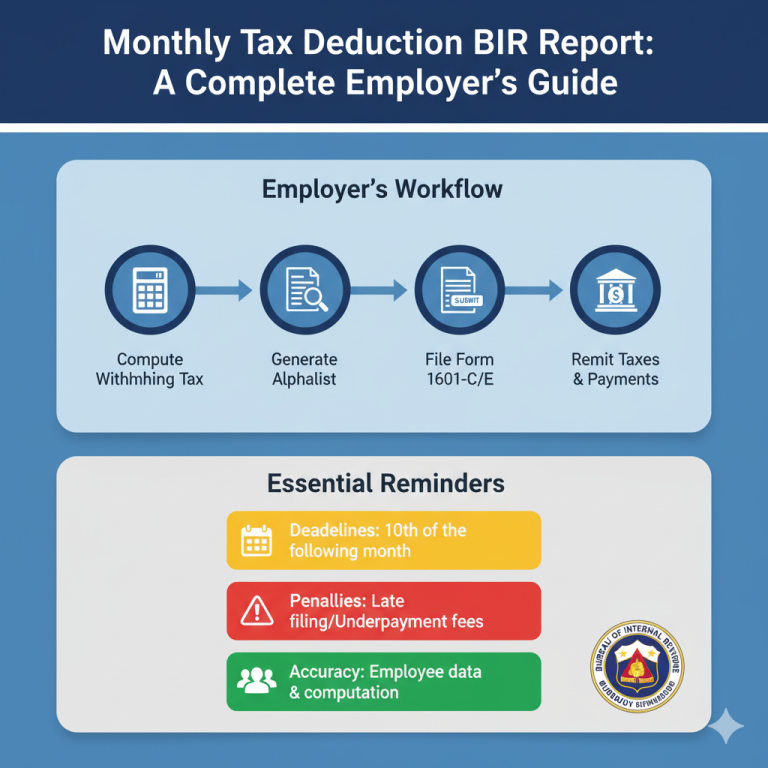

Employers in the Philippines are required by law to withhold income taxes from employee salaries and remit them to the Bureau of Internal Revenue (BIR). These withheld amounts are submitted and reported through the Monthly Tax Deduction BIR Report, ensuring…

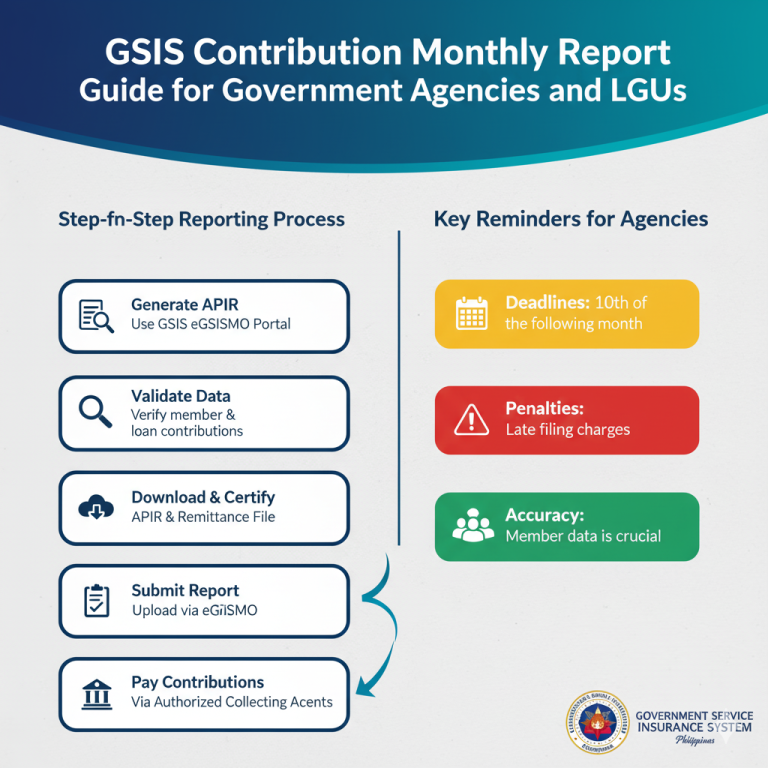

For government employees in the Philippines, the Government Service Insurance System (GSIS) is one of the most important institutions safeguarding their future. GSIS provides social security benefits such as retirement, life insurance, loans, and disability coverage. To fund these benefits,…

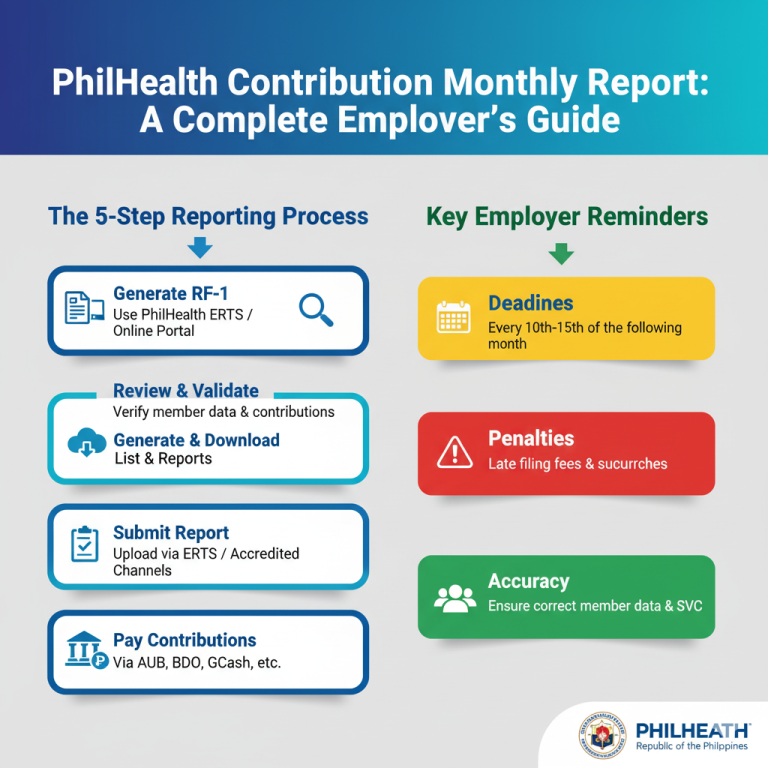

Employers in the Philippines are legally required to remit and report their employees’ PhilHealth contributions each month. This is done through the PhilHealth Contribution Monthly Report, which ensures that employee contributions are correctly recorded and credited to their accounts. Timely…

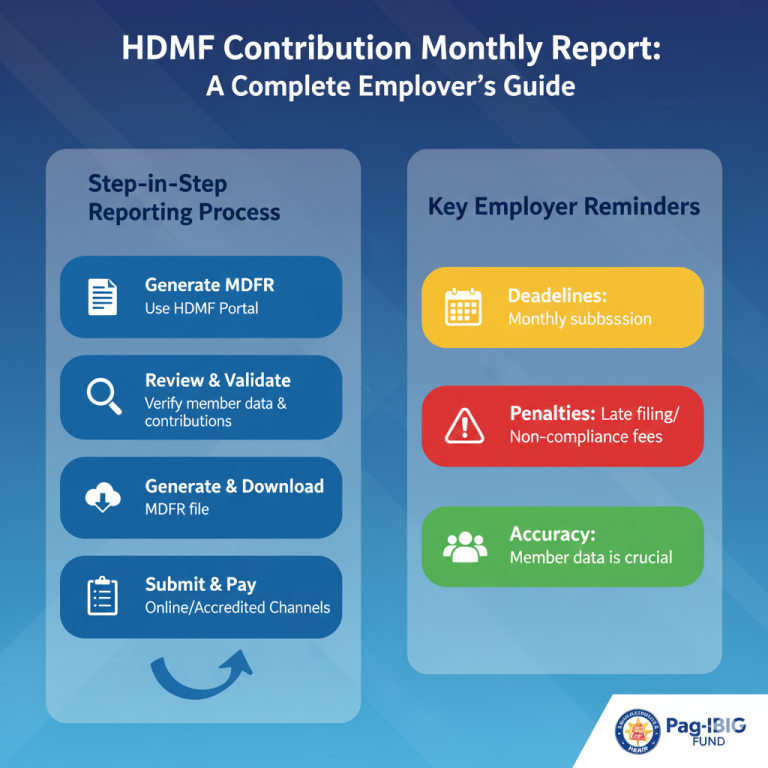

In the Philippines, every employer is required to remit Home Development Mutual Fund (HDMF) contributions, more commonly known as Pag-IBIG contributions, for their employees. Alongside payment, employers must also file the HDMF Contribution Monthly Report to ensure that contributions are…

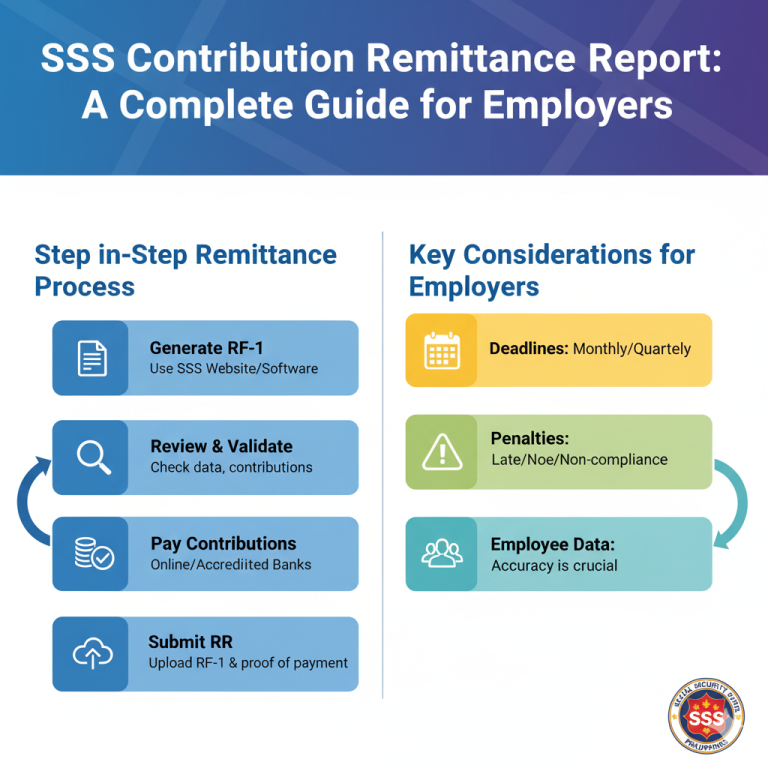

In the Philippines, employers have the legal obligation to remit their employees’ Social Security System (SSS) contributions every month. One of the key requirements is the SSS Contribution Remittance Report, also known as the R3 report. This document ensures that…