Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

Human Resource Management System

Managing employee leave benefits is a critical yet time-consuming HR responsibility. From tracking vacation days and sick leave to ensuring compliance with company policies, manual processes often lead to errors, confusion, and payroll mismatches. That’s where a Human Resource Information…

Managing employee payroll is one of the most critical—and complex—functions in any HR department. Between calculating salaries, bonuses, allowances, and deductions, HR teams often spend countless hours on manual adjustments and cross-checking spreadsheets. That’s where a Human Resource Information System…

In today’s fast-paced business environment, Human Resource Information Systems (HRIS) have become essential tools for efficient workforce management. HR professionals are under constant pressure to manage data, streamline operations, and deliver a better employee experience—all while minimizing manual work. That’s…

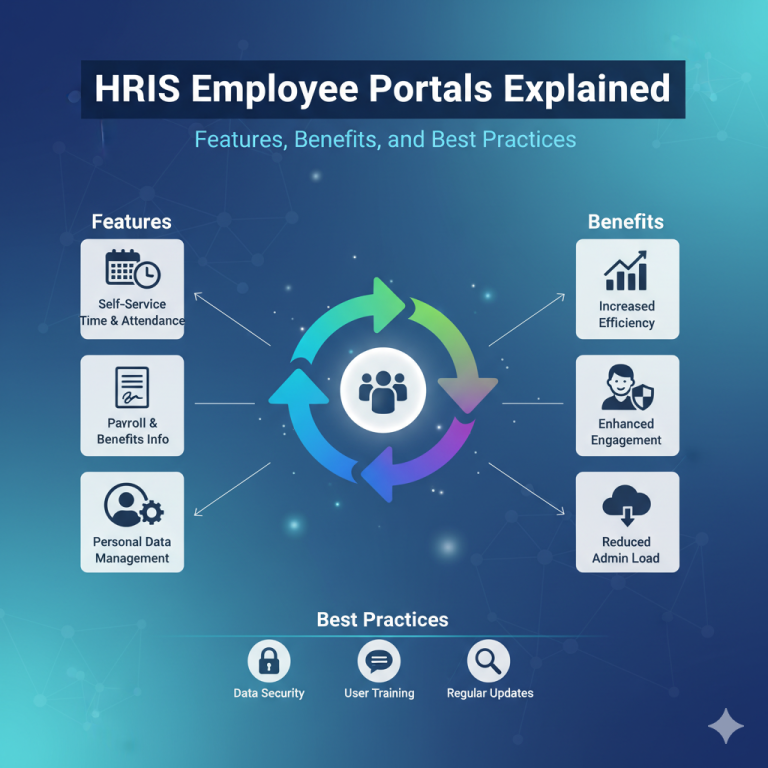

In today’s digital workplace, Human Resource Information Systems (HRIS) have become the backbone of modern HR management. An HRIS employee portal is more than just a digital dashboard—it’s a centralized hub that empowers employees to manage their HR-related tasks with…

Payroll might seem like a routine HR function, but even the smallest mistake can lead to financial losses, employee dissatisfaction, and compliance penalties. Whether it’s a miscalculated overtime rate or an unreported tax deduction, payroll errors can silently drain your…

In today’s data-driven world, Human Resource Information Systems (HRIS) are more than just digital filing cabinets—they’re strategic tools that help HR professionals make informed decisions. From tracking attendance to analyzing turnover rates, HRIS reports provide the insights needed to manage…

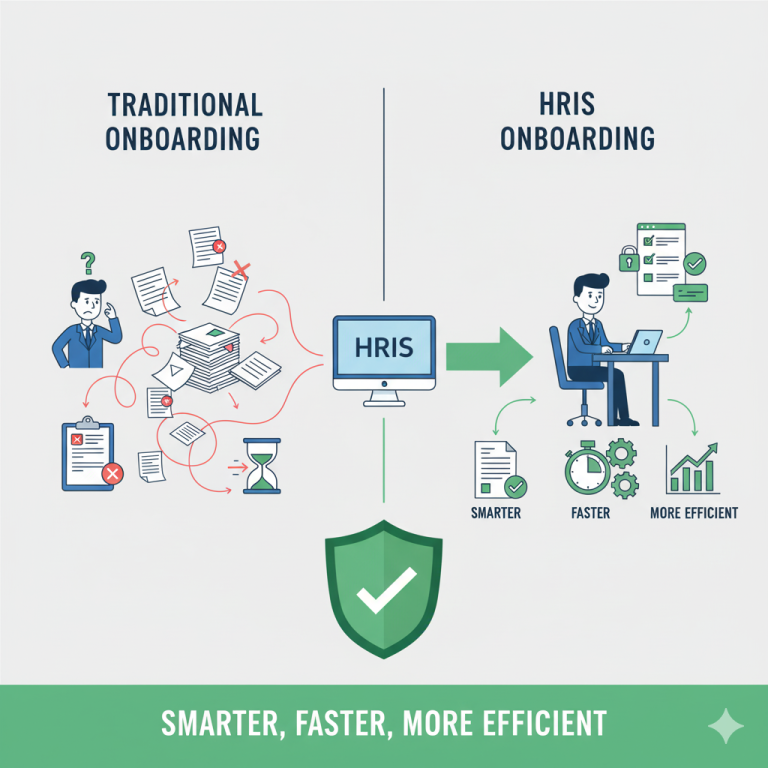

The first few days of an employee’s journey can define their long-term success in your organization. A well-structured onboarding process helps new hires feel welcomed, informed, and ready to perform. However, traditional onboarding methods—paper forms, manual data entry, and scattered…

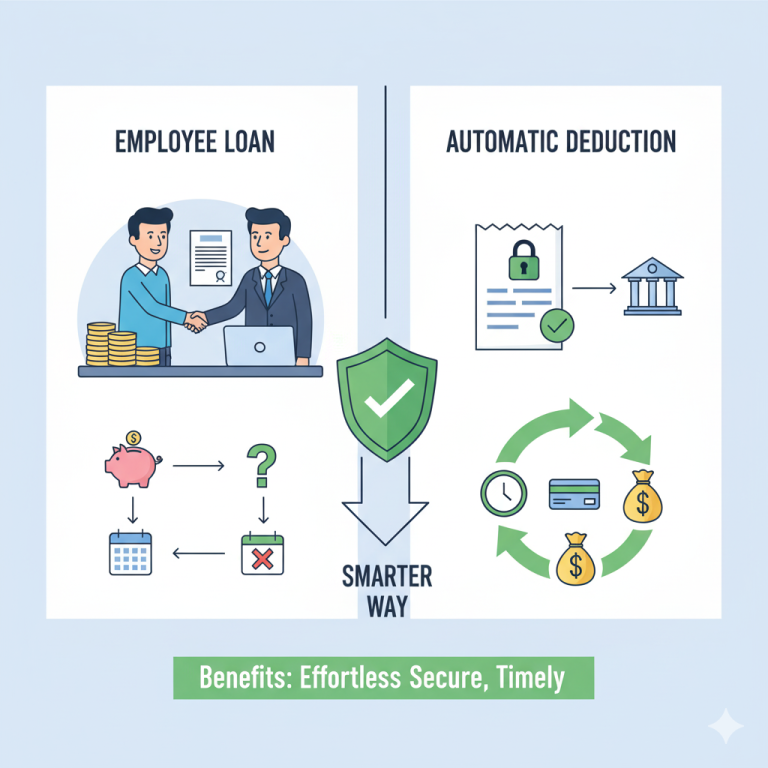

Managing employee loans can be challenging—especially when repayments are handled manually. Mistakes in deduction amounts, delays in updates, and lack of transparency can create unnecessary stress for HR, finance teams, and employees alike. That’s where automatic payroll deductions come in.…

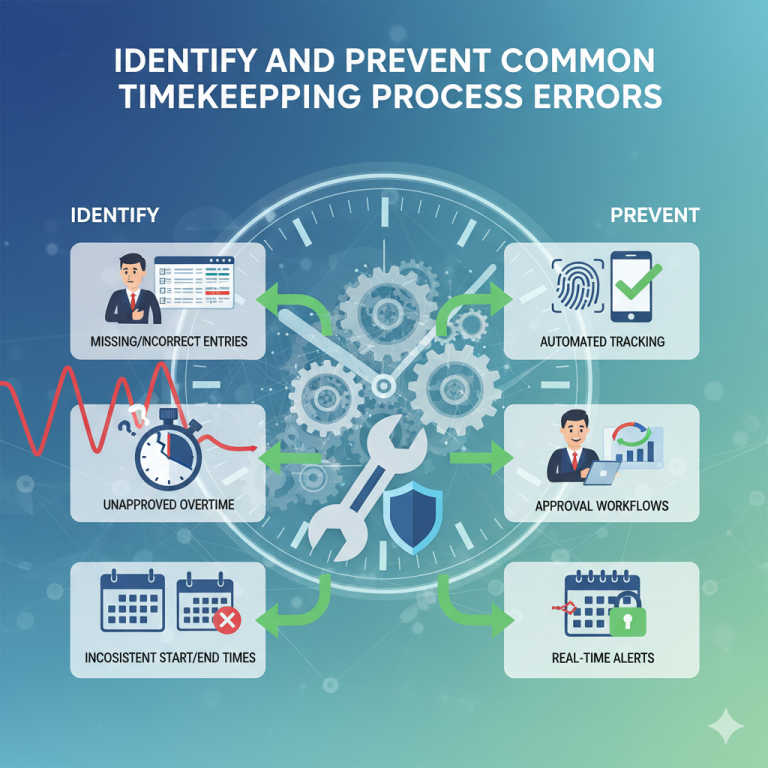

Accurate timekeeping is the backbone of productivity, payroll accuracy, and operational efficiency. Yet, many organizations still struggle with timekeeping errors that lead to compliance risks, inaccurate labor costs, and frustrated employees. Understanding where these errors originate—and how to prevent them—is…

In the Philippines, every employer has a legal responsibility to withhold and remit taxes from their employees’ salaries to the Bureau of Internal Revenue (BIR). This process, known as BIR monthly tax deduction remittance, ensures that employees’ income taxes are…