Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

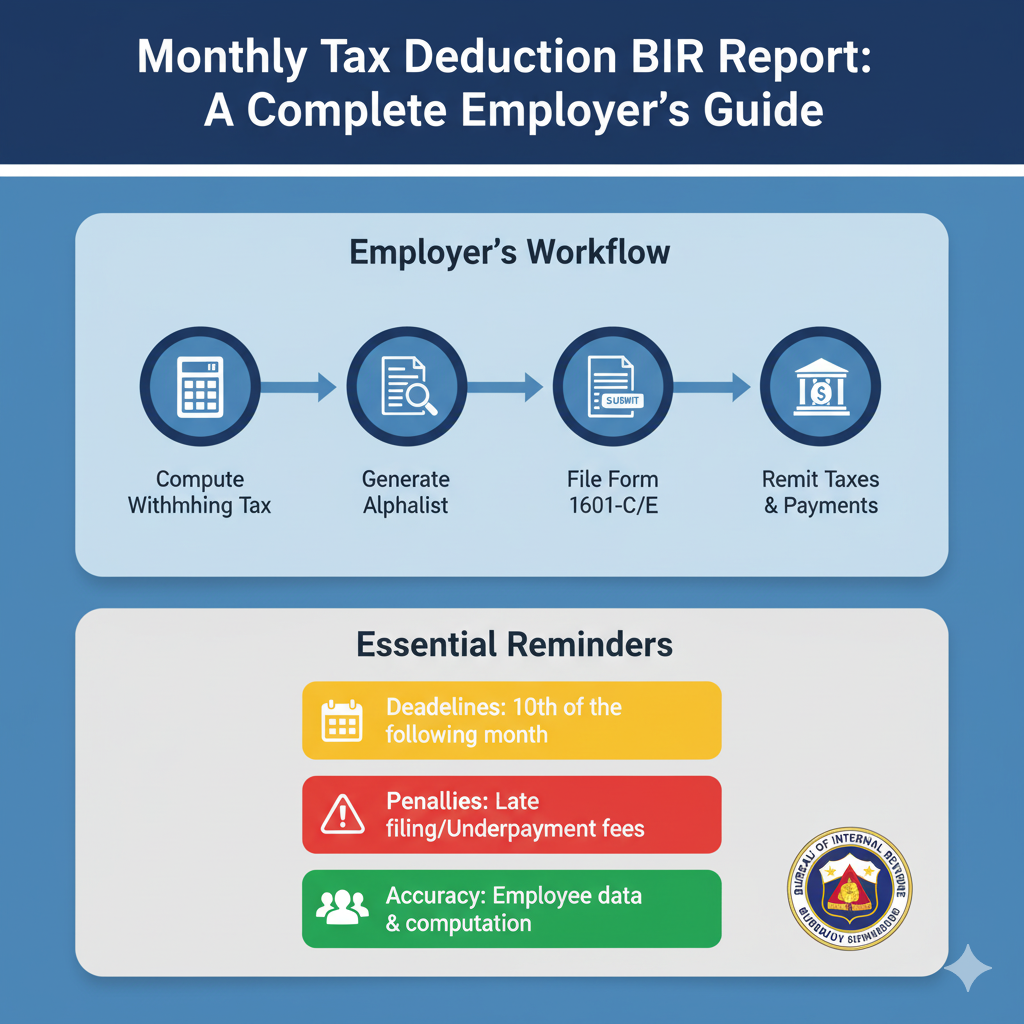

Employers in the Philippines are required by law to withhold income taxes from employee salaries and remit them to the Bureau of Internal Revenue (BIR). These withheld amounts are submitted and reported through the Monthly Tax Deduction BIR Report, ensuring that employees’ income taxes are properly credited.

Failure to file and remit on time may result in penalties, surcharges, and interest, which could harm both the employer’s compliance record and employees’ tax obligations.

This guide provides a step-by-step walkthrough for filing the Monthly Tax Deduction BIR Report, including deadlines, common errors, and best practices to help employers stay compliant.

The Monthly Tax Deduction BIR Report refers to the withholding tax return filed by employers to declare and remit the income taxes withheld from employee salaries.

Employers use the following BIR forms:

The following entities must file the Monthly Tax Deduction report:

👉 In short: If you have employees and deduct withholding taxes from salaries, you must file this report.

Employers must file and remit on or before the 10th day of the following month.

📌 Example:

Withholding taxes deducted in August → Must be filed and remitted by September 10.

For taxpayers enrolled in the Electronic Filing and Payment System (eFPS), deadlines may follow a staggered schedule based on the industry classification.

Late filing leads to:

Employers are now required to file via:

👉 Fill out the form, validate, and generate the electronic file.

Payments can be made through:

❌ Error 1: Using the Wrong BIR Form

Many employers mistakenly use outdated or incorrect forms.

✅ Solution: Always check the latest BIR circulars and use updated eBIRForms.

❌ Error 2: Incorrect Tax Computation

Errors in applying the withholding tax table result in over- or underpayment.

✅ Solution: Automate payroll computations or double-check against the latest BIR withholding tax tables.

❌ Error 3: Late Filing and Payment

Delays result in penalties and surcharges.

✅ Solution: Set internal payroll and tax filing cut-offs a few days before the BIR deadline.

❌ Error 4: Missing Employee Updates

Failure to include new hires or exclude resigned employees leads to inaccurate filings.

✅ Solution: Coordinate regularly between HR and accounting teams.

Employers who fail to remit and report properly may face:

✅ Use payroll systems integrated with BIR withholding tax computations.

✅ File and remit taxes at least 2–3 days before the deadline to avoid last-minute issues.

✅ Train HR and accounting staff on tax compliance.

✅ Keep both soft and hard copies of filings and proof of payment.

✅ Monitor BIR announcements for updated tax tables and filing procedures.

The Monthly Tax Deduction BIR Report is a critical compliance requirement for all employers in the Philippines. By filing accurately and on time, employers not only avoid costly penalties but also ensure that employees’ income taxes are properly credited.

Following this step-by-step guide — from payroll preparation to online filing — will help businesses, LGUs, and organizations stay compliant and maintain smooth operations with the BIR.

Compliance with monthly tax deductions is more than just a legal responsibility; it is a commitment to proper governance and accountability.