Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

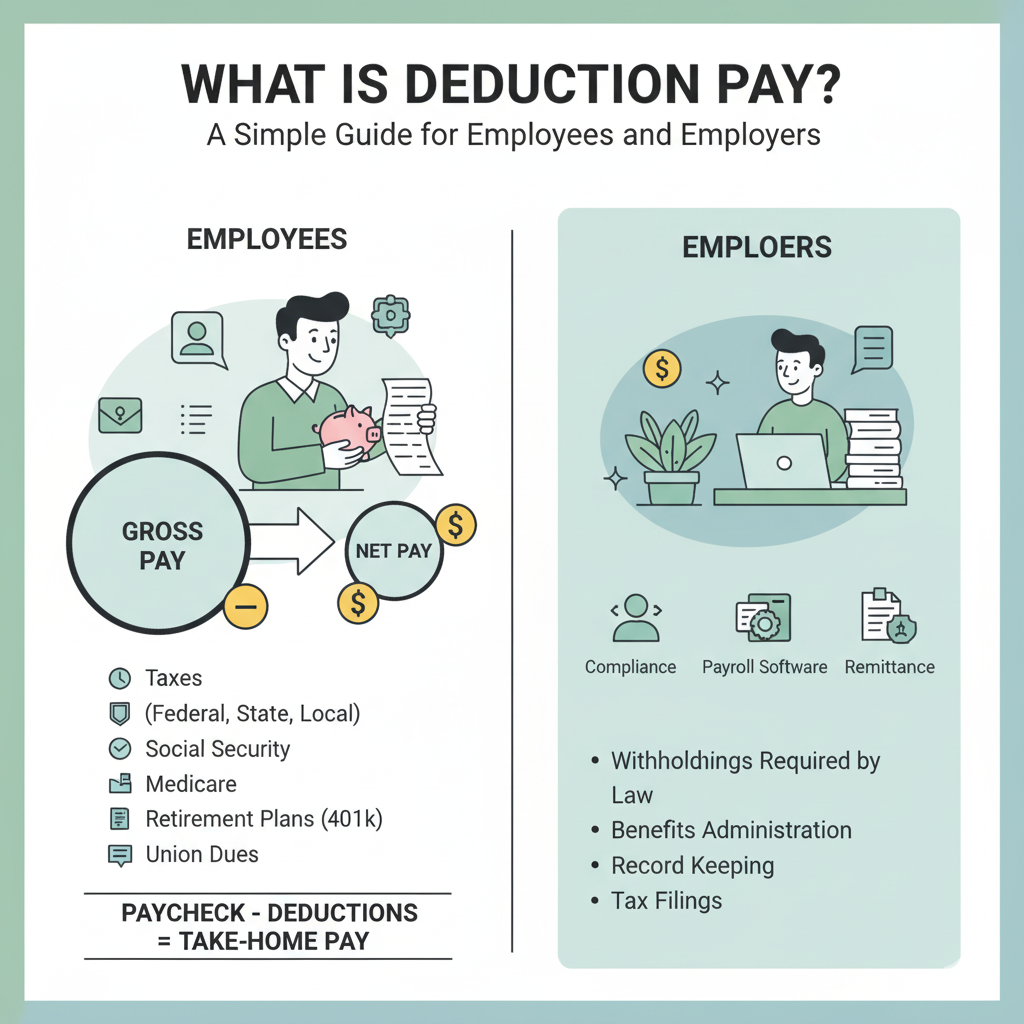

If you’ve ever received your payslip and wondered why the amount you take home is lower than your gross salary, you’re not alone. This difference is due to deduction pay. Understanding what gets deducted — and why — is essential for both employees (to know their rights) and employers (to ensure compliance and transparency).

In this guide, we’ll break down what deduction pay means, the common types of deductions, and how both sides can manage payroll effectively.

Deduction pay refers to the portion of an employee’s salary that is withheld by the employer to cover required or authorized expenses. These deductions reduce the gross salary to arrive at the net pay — the actual amount that goes into the employee’s bank account.

Employers are legally required to deduct and remit these payments to government agencies:

These ensure employees are covered by social benefits and comply with government tax laws.

These are deductions that employees agree to in writing:

Employers may deduct certain amounts if permitted by law or contract:

⚠️ Employers must ensure deductions are legal, authorized, and transparent to avoid labor disputes.

👉 Example:

Gross Salary = ₱30,000

Taxes & Contributions = ₱6,500

Loan Repayment = ₱2,000

Net Pay = ₱21,500

Deduction pay is a normal part of every payroll system, but both employees and employers must understand it clearly. Employees should know where their money is going, while employers must ensure deductions are fair, legal, and transparent.

When handled properly, deduction pay builds trust, compliance, and financial security for everyone involved.