Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

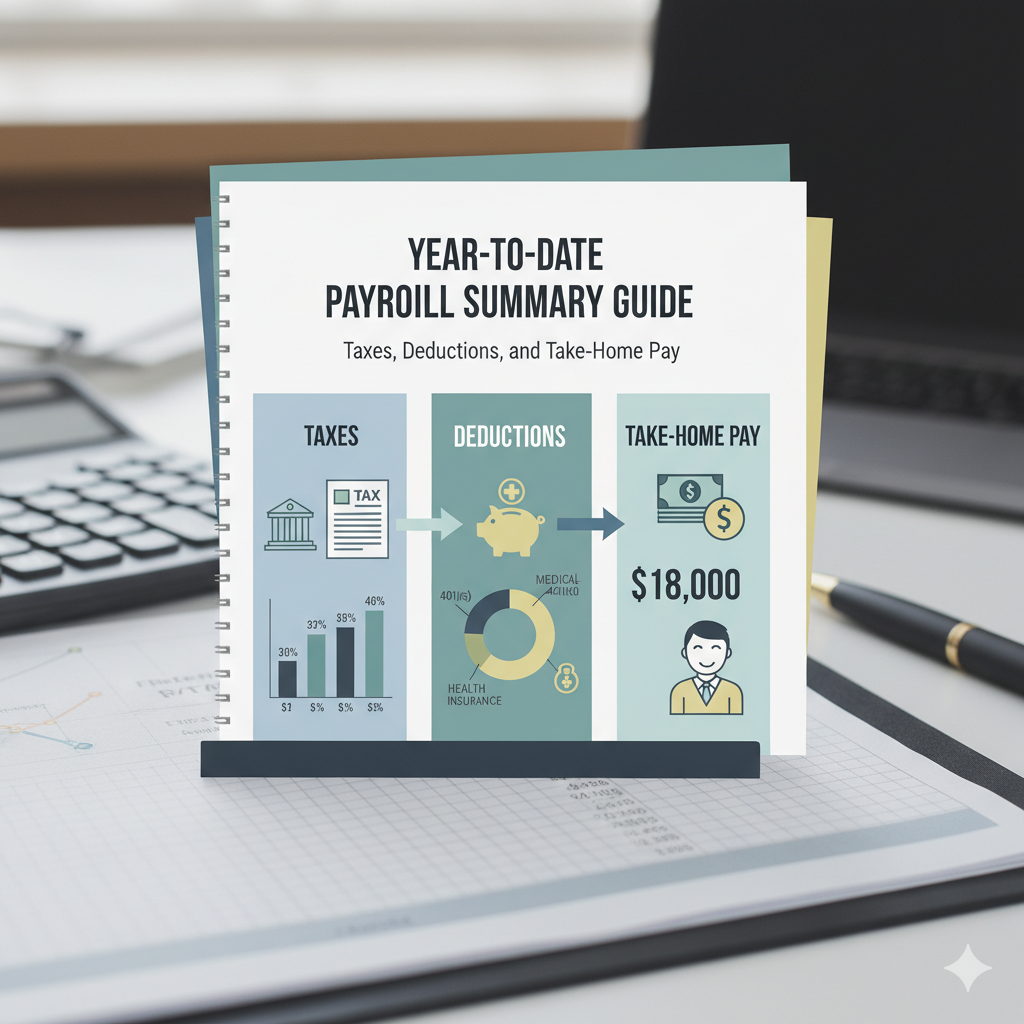

If you’re an employee in the Philippines, your payslip contains more than just your salary—it’s a record of your earnings, deductions, and contributions. One of the most important sections is the Year-To-Date (YTD) Payroll Summary, which shows the total amounts you’ve earned and paid since the start of the year.

Understanding your YTD payroll summary is essential for budgeting, tax compliance, and financial planning. This guide will walk you through everything you need to know about gross pay, deductions, contributions, and take-home pay in the Philippine payroll system.

A YTD Payroll Summary is a running total of your salary, taxes, and deductions from January 1 up to your most recent payroll cycle.

In the Philippines, this usually includes:

At year-end, your YTD totals form the basis of your BIR Form 2316, which is required for annual income tax reporting.

Monitoring SSS, PhilHealth, and Pag-IBIG ensures your employer remits correct amounts, protecting your benefits.

Understanding your gross vs. net pay helps you plan expenses, savings, and investments.

Many banks require payslips or YTD summaries as proof of income for credit cards, housing loans, or car financing.

Your gross pay includes:

Every employee in the Philippines contributes to:

Employers deduct withholding tax each payday based on BIR’s graduated income tax rates (TRAIN Law). This is credited against your annual income tax due.

These may include:

This is the final amount after all deductions. It reflects what you can actually use for your monthly budget.

Your Year-To-Date Payroll Summary is more than just numbers on a payslip—it’s a reflection of your earnings, taxes, and government contributions in the Philippines. By understanding how it works, you can ensure compliance, protect your benefits, and plan your finances more effectively.

Whether you’re budgeting, applying for a loan, or preparing for tax season, knowing how to read your YTD payroll summary empowers you to take control of your financial health and take-home pay.