Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

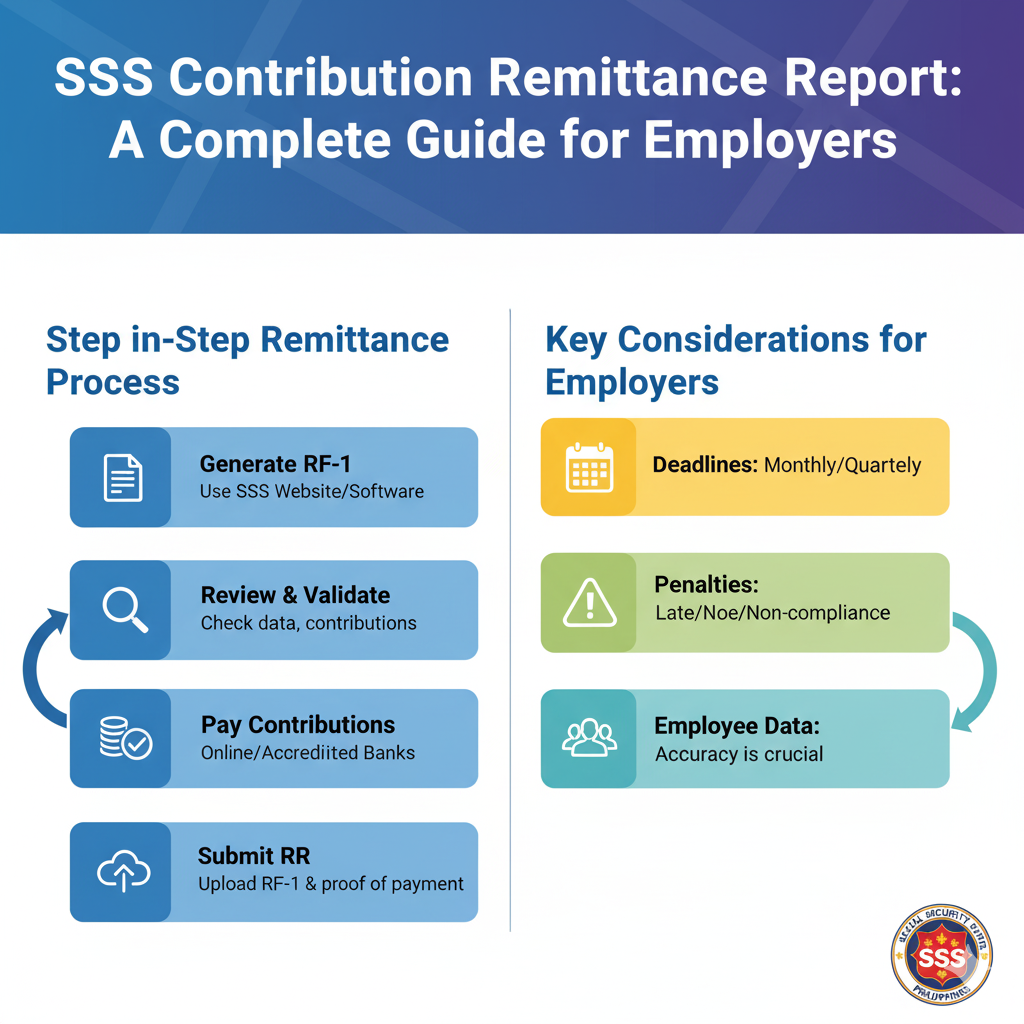

In the Philippines, employers have the legal obligation to remit their employees’ Social Security System (SSS) contributions every month. One of the key requirements is the SSS Contribution Remittance Report, also known as the R3 report. This document ensures that employees’ contributions are properly recorded and credited to their SSS accounts.

Failure to submit this report on time can lead to penalties, surcharges, and even issues with employee benefits. This complete guide will walk you through the essentials of filing the SSS Contribution Remittance Report, step-by-step instructions, and tips to avoid compliance mistakes.

The SSS Contribution Remittance Report (R3 Report) is a monthly document that employers must submit to the Social Security System. It contains:

This report serves as proof that employers are fulfilling their responsibility to remit SSS contributions.

Employers must submit the SSS Contribution Remittance Report on or before the 10th day of the following month after payment.

📌 Example:

Contributions for August → Report deadline is September 10.

Late submission may result in penalties or surcharges.

Compute the employer and employee contributions based on the latest SSS Contribution Schedule.

Pay via:

Employers have two options:

After submission:

❌ Error 1: Using Wrong Contribution Amounts

Employers sometimes use outdated contribution schedules.

✅ Solution: Always check the latest SSS contribution table.

❌ Error 2: Incorrect Employee Information

Mismatches in SSS numbers or employee names cause rejected reports.

✅ Solution: Verify employee details with their SSS records before filing.

❌ Error 3: Late Filing

Missing the deadline leads to surcharges.

✅ Solution: Mark deadlines and file at least 2–3 days before due dates.

❌ Error 4: Failure to Update Employee Status

Not removing resigned employees or adding new hires may cause discrepancies.

✅ Solution: Regularly update employee records before report generation.

Employers who fail to remit contributions or submit reports may face:

✅ Always use the Payment Reference Number (PRN) for faster posting of contributions.

✅ Maintain an updated employee masterlist.

✅ Reconcile payments with reports monthly.

✅ Keep both digital and hard copies of reports for at least 10 years.

✅ Train payroll staff in SSS compliance.

The SSS Contribution Remittance Report is a vital compliance document that ensures employees receive the social security benefits they deserve. By understanding the filing process, meeting deadlines, and avoiding common mistakes, employers can stay compliant and avoid penalties.

Staying proactive with SSS reporting not only keeps your business safe from legal issues but also builds trust with your employees by safeguarding their future benefits.