Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

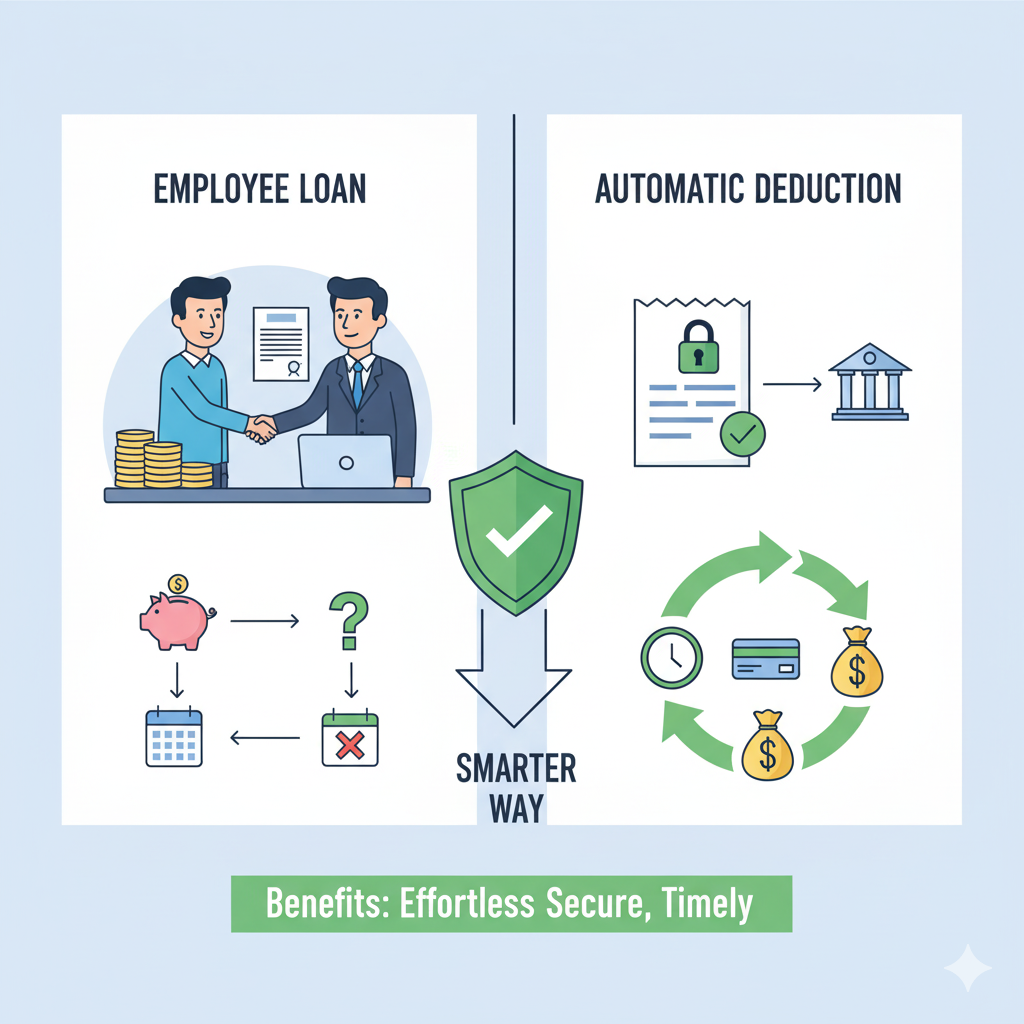

Managing employee loans can be challenging—especially when repayments are handled manually. Mistakes in deduction amounts, delays in updates, and lack of transparency can create unnecessary stress for HR, finance teams, and employees alike.

That’s where automatic payroll deductions come in. By automating the process of deducting loan repayments directly from employee salaries, businesses can ensure accuracy, save time, and improve financial management.

In this article, we’ll explore how automatic payroll deductions work, their benefits, and how to implement them effectively in your organization.

Automatic payroll deductions are system-generated loan repayments automatically subtracted from an employee’s salary during each payroll cycle.

These deductions can cover:

Once set up, the system automatically deducts the correct amount every pay period until the loan is fully repaid—eliminating manual input and reducing the risk of errors.

Automation brings both efficiency and accuracy to your payroll process. Here’s why it’s the smarter choice:

a. Improved Accuracy

Manual deductions are prone to human error. Automating ensures consistent, precise calculations based on the loan balance and repayment schedule.

b. Time Savings

Automation significantly reduces the administrative burden on HR and payroll teams, allowing them to focus on more strategic tasks.

c. Compliance and Transparency

With clear deduction records and audit trails, you maintain compliance with labor laws and provide employees full visibility into their repayments.

d. Better Employee Trust

When loan deductions are timely and error-free, employees gain confidence that their financial matters are handled fairly and professionally.

e. Easy Integration with Payroll Systems

Modern payroll software integrates seamlessly with HR and finance systems, allowing real-time tracking of loan balances and repayment progress.

The automation process is simple yet powerful:

If your organization is new to automation, follow these steps to ensure a smooth setup:

Step 1: Choose a Reliable Payroll System

Select a payroll software that supports automated deductions, integrates with HR and accounting platforms, and provides reporting tools.

Step 2: Establish Clear Policies

Define company policies for employee loans, repayment schedules, and deduction limits. Ensure transparency and compliance with labor laws.

Step 3: Train HR and Finance Teams

Provide proper training on using the system to input, monitor, and adjust deductions when needed.

Step 4: Communicate with Employees

Inform employees about how the deductions work, repayment terms, and where they can view their loan balance.

Step 5: Monitor and Audit Regularly

Regular audits help ensure deductions remain accurate and systems function as intended.

| Benefit | Description |

| Accuracy | Reduces human error in payroll processing |

| Efficiency | Saves HR time and administrative costs |

| Compliance | Maintains proper documentation and legal adherence |

| Transparency | Provides clear visibility for employees |

| Scalability | Easily handles multiple employees and loan types |

Automatic payroll deductions aren’t just a convenience—they’re a strategic tool for smarter, more efficient business operations.

By implementing automated employee loan deductions, companies can reduce errors, improve compliance, and foster a culture of transparency and trust.

If your organization still relies on manual processes, now is the time to embrace payroll automation and make employee loan management effortless.