Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

For government employees in the Philippines, the Government Service Insurance System (GSIS) is one of the most important institutions safeguarding their future. GSIS provides social security benefits such as retirement, life insurance, loans, and disability coverage.

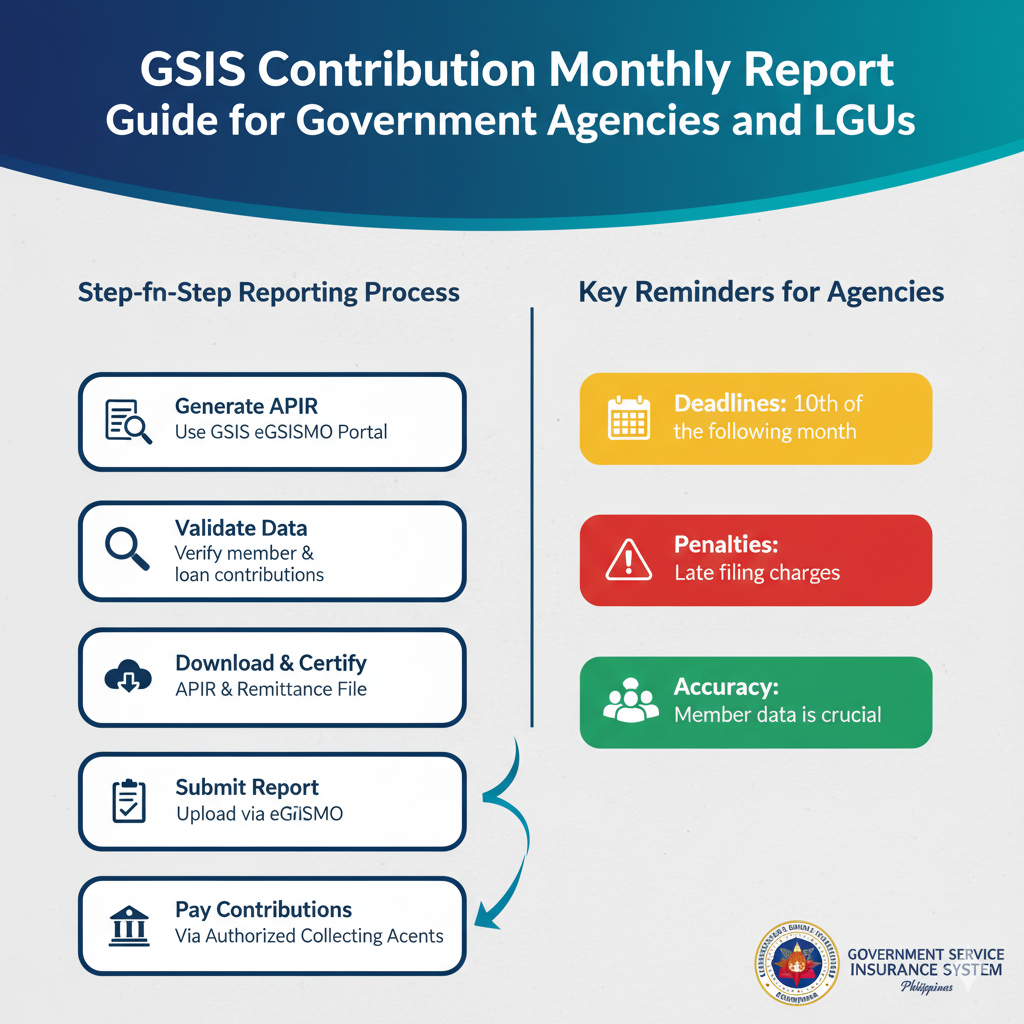

To fund these benefits, government agencies and Local Government Units (LGUs) are required to remit employee and employer contributions monthly. This is done through the GSIS Contribution Monthly Report, which ensures that contributions are correctly credited to each member’s account.

This guide will walk you through the essentials of filing the GSIS Contribution Monthly Report, deadlines, step-by-step filing instructions, and best practices to ensure compliance.

The GSIS Contribution Monthly Report is a mandatory submission by government agencies and LGUs detailing:

This report ensures that all government workers’ contributions are properly posted, enabling them to avail of GSIS benefits when needed.

The following must file monthly GSIS contribution reports:

👉 All employers under the GSIS coverage must file monthly reports for their employees.

📌 Example:

Contributions for September → Due by October 10.

Failure to remit and report on time may lead to penalties, surcharges, and delayed posting of employee contributions.

Use the GSIS eBilling and Collection System (eBCS) or the required reporting format.

Encode:

Payments can be made through:

Reports are rejected if GSIS BP numbers do not match records.

✅ Fix: Verify employee details before report submission.

Using the wrong salary base or contribution rates leads to discrepancies.

✅ Fix: Always use the latest GSIS circulars on contribution schedules.

Not including new hires or failing to remove separated employees may result in incorrect reports.

✅ Fix: Update HR and payroll records regularly.

Missing deadlines delays contribution posting and may result in penalties.

✅ Fix: Set internal cut-offs and file at least 2–3 days before the due date.

Government agencies and LGUs that fail to remit or report GSIS contributions may face:

✅ Use the GSIS eBilling and Collection System (eBCS) for efficient reporting.

✅ Maintain updated employee records to avoid errors.

✅ Reconcile payroll and contribution data monthly.

✅ Assign compliance officers to monitor deadlines.

✅ File contributions in advance to avoid last-minute issues.

Conclusion

The GSIS Contribution Monthly Report is a vital compliance requirement for all government agencies and LGUs. By filing accurately and on time, employers safeguard their employees’ future benefits, avoid penalties, and maintain smooth operations with GSIS.

Following the step-by-step process and implementing best practices ensures that contributions are remitted correctly and without delays. Compliance with GSIS is not just a legal obligation — it is also a commitment to the welfare and security of government workers.