Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Address

Kaypian, San Jose Del Monte City, Bulacan Philippines

Work Hours

Monday to Friday: 8AM - 6PM

Weekend: 10AM - 5PM

Integrated HR. Accurate Payroll.

Integrated HR. Accurate Payroll.

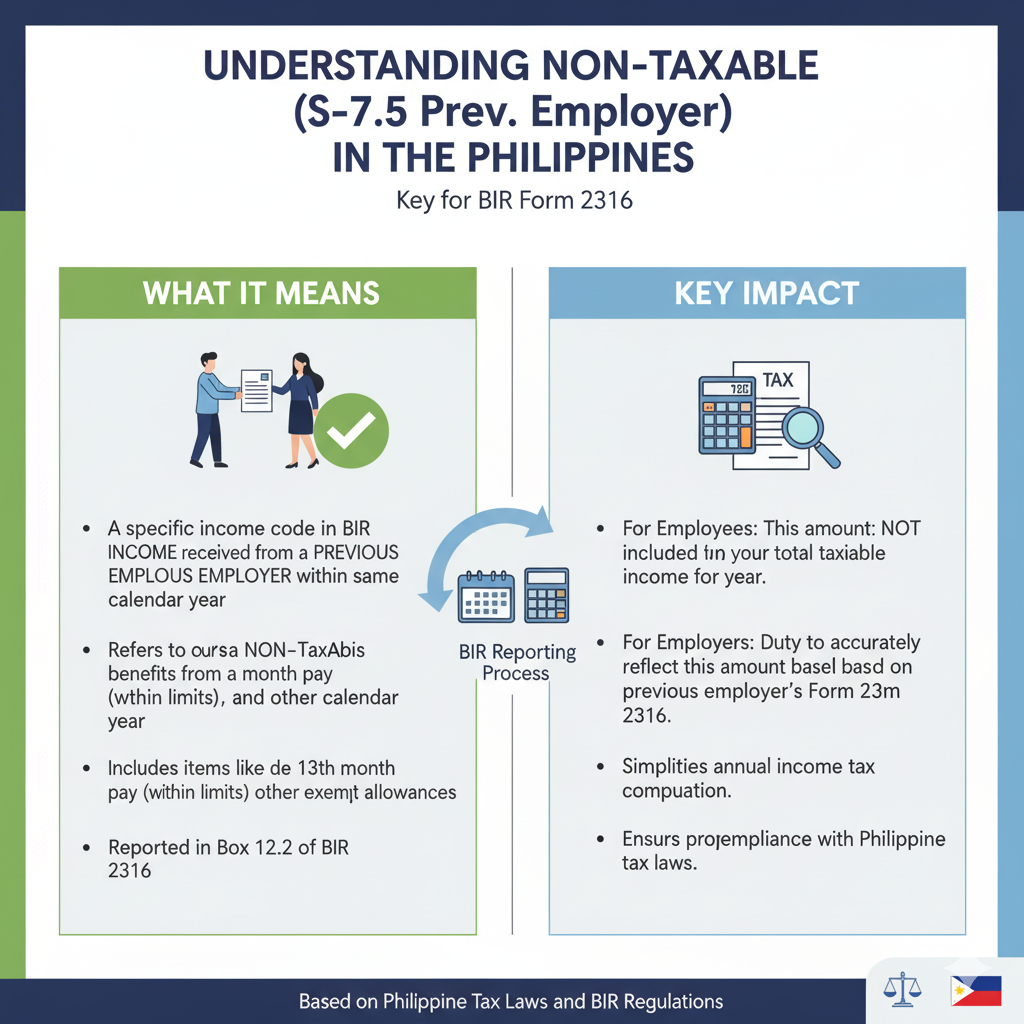

If you’ve ever reviewed your payslip in the Philippines after transferring jobs within the same year, you might have noticed a line called “Non-Taxable (S-7.5 Prev. Employer).”

This payroll code can be confusing, but it plays an important role in BIR reporting, tax compliance, and salary transparency. In this guide, we’ll explain what it means, why it appears, and how it affects both employees and employers.

In Philippine payroll systems, Non-Taxable (S-7.5 Prev. Employer) refers to the non-taxable income or benefits earned from a previous employer within the same calendar year.

When an employee changes jobs, the new employer must record both taxable and non-taxable earnings from the old employer. This ensures accurate reporting and compliance with BIR regulations.

📌 In short: It represents non-taxable income carried over from your previous employer for consolidation in annual tax reporting.

The Non-Taxable (S-7.5 Prev. Employer) entry appears because:

This avoids misreporting and ensures that non-taxable benefits remain exempt even after a job transfer.

Mark worked at Company A from January to June, where he received:

₱400,000 taxable salary

₱50,000 in non-taxable de minimis benefits

When he transferred to Company B in July:

Company B recorded ₱400,000 under Taxable (S-7.4 Prev. Employer)

₱50,000 under Non-Taxable (S-7.5 Prev. Employer)

This way, Mark’s total income was reported correctly, and his ₱50,000 in non-taxable benefits stayed exempt from tax.

For Employees

For Employers

The payroll entry “Non-Taxable (S-7.5 Prev. Employer)” is not something to worry about — it simply represents non-taxable benefits carried over from a previous employer in the Philippines.

It ensures that allowances, benefits, and contributions remain exempt even when you change jobs, keeping payroll and BIR reporting accurate and compliant.